Brackets Cable bearer galvanized install stamping parts

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1000 pc

- Supply Capability:

- 10000 pc/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

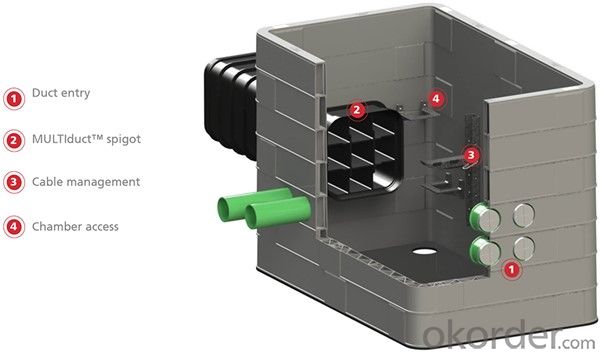

1.Galvanised steel wall brackets for mounting cable bearers

2.Used with cable bearer wall type and locking pins. The type number indicates the effective length

3.Galvanised steel concrete foundation mounting bolts

4.Galvanised steel pin for securing bracket cable bearers to channel brackets

.

.

Product Description:

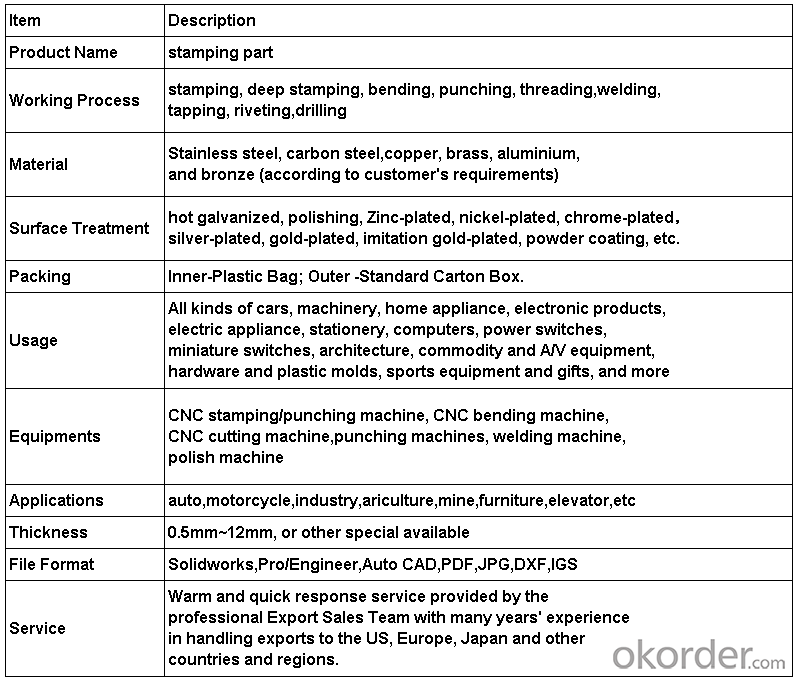

sheet metal stamping parts

Stamping Parts:

Stamping Parts and Machined Parts:

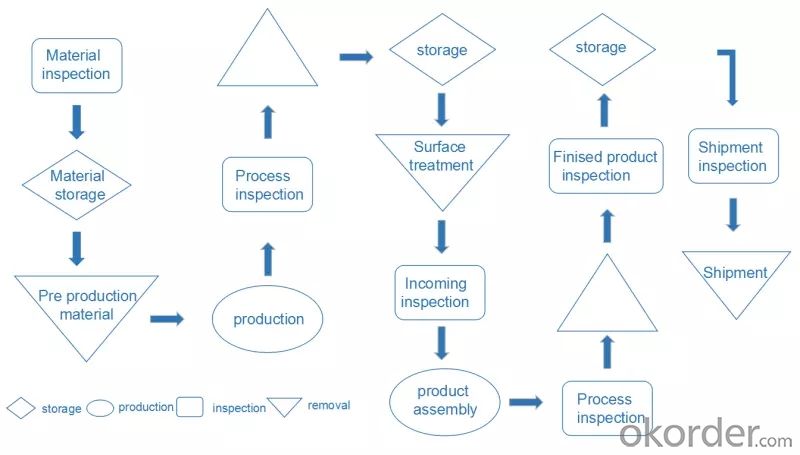

QC Engineering Graphics:

Production Capacity:

Production Workshop & Equipment:

The Way Of Shipping:

FAQ:

Q1.What is your main products?

A1:Our main products are stamping parts and machined parts.

Q2. How to ensure that every process's quality?

A2:Every process will be checked by our quality inspection department which insures every product's quality. In the production of products, we will personally go to the factory to check the quality of products.

Q3.How long is your delivery time?

A3:Our delivery time is generally 30 to 45 days. Or according to the quantity.

Q4. What is your payment method?

A4:30% value of T/T in advance and other 70% balance on B/L copy.

For small order less than 1000USD, would suggest you pay 100% in advance to reduce the bank charges.

Q5.Can you provide a sample?

A5:Sure, Our sample is provided after receiving the tooling cost and courier fees.

- Q: I have a loose braces bracket, and I was wondering would my teeth move still with that one bracket being loose? I already contacted my orthodox. But my teeth doesn't feel pressure because I got an adjustment about 4hrs ago. Am I not feeling pressure bc my wires are not right enough??

- It will be ok for about 1 week as the other teeth won't move that much. As long as you get it fixed asap you will be fine. It is quite common after tightening as the bracket glue comes loose. Hope this helps you! :)

- Q: I need to get my curly brackets *{ and }* to enclose several lines. I really don't want to put in texts boxes if I don't have to, because I know there has to be another way to do this.

- In Word 2007 Choose the Insert Ribbon Then shapes and draw using the left brace. In 2003 choose View Toolbars and Drawing and use the same bracket. To get the same sized brakets again. Select the graphic you have drawn. Choose Alt F3 and give the bracket a name then thye in the name and press F3 when ever you require the symbol. If you are not happy with exact size and position you can draw a table with merged cells spanning the multiple row of your paragraph but this is probably to elaborate for your needs.

- Q: I read the tax brackets for 2013 and i was wondering, what tax does this refer to? is it just federal tax or does it include all the other little local/state taxes?for example, if a person who is Single earns $100,000, the tax bracket is 28% but someone I know who earns around that much gets more than 28% taken away. what are the other deductions?could someone please enlighten me?? thanks.

- Each okorder

- Q: i was eating something hard, and then when i washed my teeth i felt something poking my cheek, when i looked at it, it was a loose bracket.i can probably go to the orthodontist in 3 days, but is it an emergency, can it be dangerous for my teeth in any way? i live in a boarding school so my original orthodontist is far, and i am kind of scared of meeting another one here just please tell me if it is an emergency , and if it could be any danger for the growing of my teeth? Thank you very much in advance :)

- Hi hun, first of all don't panic, its not a huge issue and won't damage the eventual outcome. This has happened to me couple of times (i'm one and half years in braces). First time the poking in MY cheek, was due to the wire jumping out of the bracket. If you can't get to an orthodontist quickly, you can, if you have a good magnifying mirror. pop it back into the bracket. If its the actual bracket that has fallen off the tooth, as your question seems to suggest, then it needs to be glued back on. So if you can get to someone, it would be better to do it sooner rather than later. If only because of the sheer inconvenience of eating / swallowing with the thing dangling in your mouth. Providing you so so, it won't make much difference if any, to the timescale your orthodontist was already working to for you.

- Q: A couple of weeks ago I had been babysitting and accidentely eaten a hard candy which my the the bracket on the right side of mouth on my molar come off.i can understand that but it does not have a wire on it and it did not come off until morning soooo? then i woke up this morning and the other sides bracket came off and i swear that i didn't do anything to mess it upi had a chewy browny and pizza that was squishy and the crust wasnt hardfor lunch i had fries and chickenand i didn't have breakfastfurthermorei had tested each one b4 i went to bed to make sure they were on securely and i was not rough on them eitherWHAT'S GOING ON?!! also do orthodontists make you pay for bracket replacement?

- Sometimes the brackets have a hard time staying on the teeth because of saliva contamination at the time of placement. The adhesion might have been weak and it didn't take much to knock them off. Yes, tooth grinding could dislodge them if there was contact between the opposing tooth and the bracket when you bite down. I would return to the orthodontist and have them fuse the bracket back on. I don't think there will be a charge especially if it didn't happen before (or too often).

- Q: A bracket fell off my tooth.The wire is just hanging out there.Its poking me.its really annoying.What should i do?Will my teeth get messed up over this one broken bracket?My next appointment is in 6 weeks.should I go sooner or is it not a big deal?

- i have had braces and the first time on fell off i freaked a little too, but it happens a lot so don't worry. Your teeth shouldn't be messed up it it isn't on there for a few weeks, but if it is uncomfortable then call the orthodontist and they can schedule and quick meeting to glue a new one on.

- Q: I only have top braces right now, but the braces on the tooth alllll the way in the back of the right side of my mouth seems to have a broken bracket. It doesn't hurt or anything, but I feel it poke my cheek occasionally. I have an orthodontist appt in a few weeks anyhow, but should I call sooner? Is it bad to just leave it alone? Please gimme an answer!

- call. if u dont it can delay the time you wear braces for

- Q: I was just wondering what are bottom bracket spacers for?

- Bottom bracket spacers are to ensure your cranks are centered on the bike and drivetrain. While a misaligned drivetrain is a headache for performance and maintenance, the resultant misaligned cranks can wreak havoc on your knees. Read the manual and do it right. If in doubt, leave it to the pros.

- Q: I just got braces today, and my ortho did not explain brushing all that well. So bascially i have two questions1. Can you use a high powered electric toothbrush?- I have a massage/clean method oral braun b2, Can you brush on the brackets? I guess im just kinda worried about them falling off or something from brushing

- It would take a pretty good amount of pressure to knock a bracket loose. Definitely you should brush thoroughly either manually or with an electric toothbrush. It's actually harder to brush with braces so you have to pay close attention to detail. The worst problem I had with braces was the sores they made on the insides of my lips.The wax they gave me to cover up the length of the wire helped lots. Ask for more of that every time you go in, because if you need it you will really need it. And if you knock a bracket loose just once it's usually not a big deal. You just need to let them know before your appointment and they'll glue it back on. I wore braces for 2 and 1/2 years and never knocked one loose.

- Q: I guess kind of a double question. I'm going to a concert May 21st. What would be best exposure setting? In a non dslr camera can you bracket? Begining to think I can't. Isn't it true that when you set camera to either aperture priority or shutter priority one would compensate for the other to get propper exposure? I guess you can bracket on a dslr which I don't own. I own the Sony DSC-H2.

- Try your spot meter on the main subject. Unless you are right on stage, anything else will grossly overexpose the band/singer, because it will be misled by all the darkness in the field. You can bracket on your H2, although you may not be able to do this automatically, so it will slow you down a bit. Haha! How spoilt we have become. What I am saying is that you will have to bracket on your 21st century electronic marvel the way we did before cameras even had light meters - one frame at the time. Just use your exposure compensation by setting the EV up and down. For sake of speed, you might want to use full stop increments instead of the 1/3 stop that is available with a single click. Try shooting as soon as the lights go down and review your pictures immediately. If your H2 has the option to indicate the highlights that are overexposed, set that so you can check quickly and adjust. Once you find what works, meaning if EV -1.3 is the right exposure compensation, you can probably quit bracketing unless you notice that the lights are changing all the time. You are correct about the aperture and shutter priority settings. These settings measure the light lever and set the EV (exposure value, I think) and then make proporional adjustments to maintain that same EV. You can STILL bracket in one of these modes, though, since you will still be able to change the EV through exposure compensation as I described above.

Send your message to us

Brackets Cable bearer galvanized install stamping parts

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1000 pc

- Supply Capability:

- 10000 pc/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords