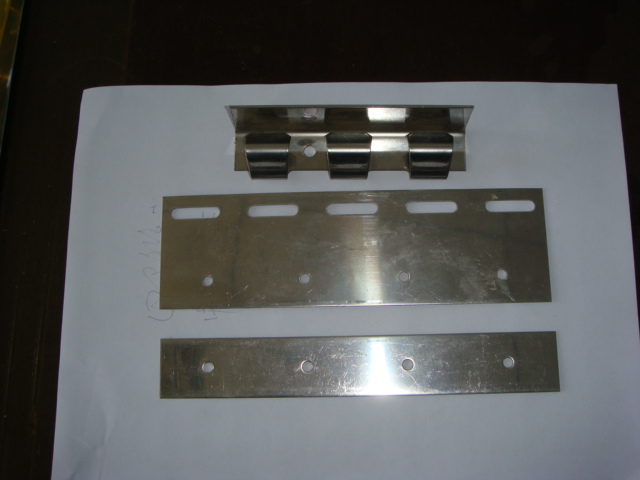

hanger for pvc strip curtain

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

1. Rail Size: 1m(length)x25px(thickness)

2. Clip Size:

150mm(w)x1mm(t)

200mm(w)x1mm(t)

300mm(w)x1mm(t)

Material: SS201,SS304,G.I

Application:

Applications of PVC Strip Curtain Hardware

One set of hanger include 3 ways

A. 1m rail, 8sets clips and 24 pcs screws, be applicable for 150mm and 200mm wide PVC strip

B. 1m rail, 6sets clips and 18 pcs screws, be applicable for 200mm and 300mm wide PVC strip

C. 1m rail, 4sets clips and 16 pcs screws, be applicable for 300mm and 400mm wide PVC strip

Package& Delivery of PVC Strip Curtain Hardware

Wooden pallet,Carton box according to custom requires.

Installation of PVC Strip Curtain Hardware

1.Cutting

Measure the size of door and cut the PVC strip curtain accordingly. Make sure the angle is 90 degree; Be carful with the cutter

2. Punch hole

a) Pushing holes in one side of PVC strip curtain

b) 200mm width door curtain need 3 holes

c) 300mm width door curtain need 4 holes

3. Install holders

a) Butt holders to the PVC strip with Screw.

b) Make sure the angle between strip and holders is 90 degree

4.Install hangers

Choose the best tool to punch hole according to the material of wall

- Q: I broke another bracket on my braces and I need to know a nontoxic way to reattach it MYSELF. I can't go to the orthodontist cause I broke so many that they charge $30 for every emergency appointment and are getting very mad. I need help before my tooth starts moving!!Thanks and God bless!

- i dont think it would be safe to do it yourself. you should definetly go to the orthodontist

- Q: all i want is a LINK to `easy to follow` `clear` photo step by step of REMOVING and PUTTING ON the gear cassette.

- you mean crankset. well the best would be to buy a book on bicycle repair maintenance such as from rodale press( bicycling magazine). or bike repairs for dummies. go to youtube search crankset removal and bb removal for vidz. you'll need the correct tools to do it also so why not go to local bike shop and ask them for a demo and what tools are required for your bike. buy the tools and parts from your LBS (local bike shop). tools like ratchet, socket, breaker bar you can get from anywhere such as walmart, sears, hardware store.

- Q: I am having a problem with my bottom bracket for my BMX the bike is only 2 weeks old and has a knocking/clicking noise coming somewhere around the bottom bracket. But it only happens when I push on the pedal on the right side (sprocket side) and when I put pressure on it. I have tried new pedals but that's not it I have even took apart the bottom bracket and greased the bearings that didn't really need doing as the bike is only 2 weeks old. and I have also checked that all of the bolts are tight! I need help fixing this as it is really annoying and makes the bike feel bad when you ride it. I took the bike to a shop and they said that there is no play and that they would charge ?15 to have a look.

- like someone said before call and see if they have a warranty my friend had this problem didnt care and a week later while jumping a 5 stair his whole bottom bracket broke free from the down tube. it was a very small crack in the down tube and the seat tube. but the bike had a small warranty and the company said it was there bad and they replaced his frame for free

- Q: If I sell my rental property this year as opposed to next year will I have to pay capital gains? I am in the 10-15% income tax bracket. Will the capital gains be calculated as income for the year I sell it and possibly send me into the next bracket? Does this have to be a long term sale to qualify?

- Please understand our tax code. while somebody incredibly makes money for the 1st time the are tax at are optimal fee (wealthy human beings) often at 35%. Then in the event that they want to invest say in a organisation they very own loan that money so yet another organisation can be triumphant and employ human beings. that money they make investments even no be counted if it incredibly is contained in the inventory industry or maybe us minions who've 401k's in case you want to take the prospect and placed your money to artwork to make additional money then it incredibly is taxed at a capital effective properties tax of 15%. So in essence they're paying 50% taxes on the money they have made. So is 50% sufficient for Obama to have additional money so he could make the alternative of which organisation the government invests in. Like Solyndra or killing the Keystone pipeline so his buddy Warren Buffet can use the prepare gadget that he owns ( Burlington) to transport gasoline from Canada to states with refineries. Yep while you're buds with Obama he will make you very wealthy. it incredibly is why Buffet is asserting human beings like him ought to pay greater. He reaps the income of extensive organisation deals to make Billions. Then Obama gave 3 BILLION to Soros so he can drill off of Brazil and we are in a position to be his perfect shopper. See human beings in extreme places all pat one yet another on the decrease back mutually as the yank stiff gets to pay the fee. Yep Gm is genuine worthwhile now additionally and yet they paid NO Taxes final twelve months and China buys greater GM vehicles than the U.S. yet heck China is construction maximum of them and paying pennies on the greenback for them. back the taxpayers are on the hook for that Bailout!

- Q: I need to know within like 3 hours for an algebra regents.

- in equations there is almost no difference between round and square brackets. take this equation for example: 5* [ 6x^2 + (3x+2)^2 ] 1 the brackets are used the same way as round brackets, they indicate to which the 5* applies. by using square ones for the second pair, you cannot mix up the brackets. in geometry we use brackets as well. the round ones are used to indicate we are talking about a point for example (1,2). this is the point where x1 and y2 the square ones are used for intervals. for example ]3,5] the variabel is greater to 3 and smaller or equal to 5.

- Q: i just got my braces yesterday, i was eating in lunch an hour ago i ate chicken strips and i felt that something fell, it was a bracket! Only half of it broke. I have no wires in the back because i'm getting 4 teeth pulled out, i only have brackets and wires in the front. Since the bracket that fell that has no wires, Should i still call my ortho?!someone help please

- Hi. I have braces too, so I know what you are going through. I had one of my brackets fall off before after I just got them on when biting into pizza crust. You should call your orthodontist because they have to make sure the main orthodontist is available when you have your next visit so he can do a bond with a new bracket. Just take it easy for the first month or so, try not to eat any really crunchy foods, since the brackets tend to crack and break. Don't worry, brackets breaking, rubber bands falling off is all normal with braces. I've gotten used to them. I've had them for 9 months now and brackets still occasionally fall off. Just call your doctor and take it easy.

- Q: i have braces and my bracket is loose and its been loose like 4 or 5 times now and they have fixed it but its loose again and im worried if there gonna ask how it became loose so what do i say help please

- Tell them the truth. Did you eat something you weren't supposed to? If that's the reason, then you should stop doing that. If you don't know why it's loose, then tell them that you don't know. They can't do anything to you, even if you did something you weren't supposed to do. Just tell the truth because they will be better able to help you if you do.

- Q: For examplesomeone making 350k a year. How much more in income tax do you think this person will pay under Obama???Just curious to see who actually knows how the tax system works in our own country.

- It's like stairs for simplicity's sake let's say the tax brackets are in 50k increments and for every bracket you go up you are taxed 5% so the first 50k is in the bottom bracket and 300-350k is the top this person's first 50k is untaxed 50-100k @ 5% $2500 100-150k @10% $5000 150-200k @ 15% $7500 200-250k @ 20% $10000 250-300k @ 25% $12500 300-350k @ 30% $15000 total tax $52,500 Notice the whole 350k isn't taxed at 30% *** These are not the real rates, just an example of how it works ***

- Q: for example, if it was 8(5-3x4/6) i have to simplify the number inside the bracket. do i do it from left to right, or do i do the multiplication and division before the subtracting?

- Order of op states parentheses first left to right. I am pretty sure. Just look up on google my dear aunt sally math thing. Should help

- Q: do you have to keep your mouth open for like an hour like when they put on the brackets or can you keep your mouth closed to put on the wires--also had 4 extractions-how long before the gap starts to close up?

- wire placement will only take few minutes. many factors will be considered as far as the time needed to close spaces is concerned such as age, bone density, malpositions, skill and of course your cooperation with your dentist. orthodontic treatment is very rewarding. be patient and follow your dentists instructions

Send your message to us

hanger for pvc strip curtain

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords