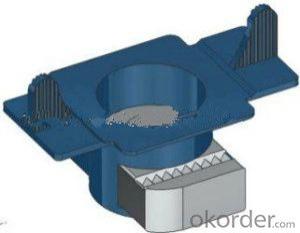

Brackets Cable bearer (pressed mild teel type) galvanized

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1000 pc

- Supply Capability:

- 100000 pc/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Used with cable bearer wall type and locking pins. The type number indicates the effective length

Also known as BT Bracket Cable Bearer 5, 8, and 12 respectively

Product Attributes

Brand:

Unbranded

Description

Bracket Cable Bearer

Length

165mm

Type

(No. 5)

| Cable Bearer types | |

| Reference | Length |

| CB Type 3 | 115 mm |

| CB Type 5 | 165 mm |

| CB Type 8 | 242 mm |

| CB Type 12 | 343 mm |

| CB Type 18 | 495 mm |

| CB Type 24 | 648 mm |

Installation:

Custom metal fabrication CNC milling sheet metal forming/stamping parts

What are Sinbo's advantages ?

1. We are a direct manufacturer

2. Quality Assurance: ISO9001-2008 Certified TUV SGS, CE certified, mature process technology/system

3. Professional Engineering Capability

4. Reasonable and competitive price

5. Both small orders and large orders are welcomed

6. More than 20 years experience in precision machining industry.

7. Professional design team and international sales team for your service

8. Maintenance service

How about your machining parts ?

Made by advanced 4/5 axis cnc machines and high precision measuring equipments to ensure quality for your every part.

Perfect surface treatment: Blackening, polishing, anodizing, chrome plating, zinc plating, nickel plating, grinding etc.

Quality certified: ISO9001:2008/SGS.

- Q: I assumed it was for information only and not actually spoken by the person being quoted, but I have tried taking out the words within the brackets and often it makes no grammatical sense at all. Jayne Blake

- The words in brackets are implied information based on what was actually said and they sometimes replace a word or 2 with the bracketed words (Or rewrite the sentence to make it work better), which is why it doesn’t make sense when you remove the bracketed phrase Example: SOURCE: The boy sped up, passed the pedestrian, and turned the corner. ARTICLE: The witness reported that she’d seen “[t]he boy [speed] up.” Or, to borrow an answer from Yahoo Journalists use brackets within quotations to put words in people’s mouths. This isn’t necessarily a bad thing! Sometimes journalists have to insert words to help to clarify a statement. Brackets are often used to identify ambiguous pronouns in a direct quotation. For example: They [the 8th Federal Infantry] fought bravely under the most adverse circumstances during the Civil War. You can also use brackets to properly place a quote within the syntax of a sentence. To decapitalize a word, for example, Doctor Fielding’s written opinion states that ’[p]atients are often deceitful.’ Square brackets are also used in conjunction with the [sic] punctuation, which is a way of distancing yourself from a misstatement or a misspelling. For example, The Delaware River is indeed a truly majestic site [sic]. Finally, to quote usage guru Bryan Garner (and conveniently use square brackets in the process), [Square brackets] enclose comments, corrections, explanations, interpolations, notes, or translations that were not in the original text but have been added by subsequent authors, editors, or others.

- Q: Does anyone know any good sites on learning to bracket, or can explain bracketing to me in an easy and simple way ? thanx

- Brackets are like paranthesis ( and ). So they go AROUND the important stuff. So if you were to BRACKET an exposure, you would have (1) correct exposure (2) under exposure - bracket (3) over exposure -bracket The under and over BRACKET (goes around) the correct exposure. So you would take 3 pictures just to make sure you have the correct exposure. Some people would take 5 pictures 1 WAY UNDER 1 little bit under 1 correct exposure 1 little bit over 1 WAY over Good Luck

- Q: I need to get my curly brackets *{ and }* to enclose several lines. I really don't want to put in texts boxes if I don't have to, because I know there has to be another way to do this.

- Try This Fantastic Store mall1.out2.pw/6c1dd

- Q: I just bought a Shimano LX Crank and am looking to get a bottom bracket for it. I've been looking at external bottom brackets (and this seems like a dumb question) but I don't know how it will work if I get one because I don't have the axle thing that connects the two arms and runs through the bottom bracket. What is that thing called and where can I get it?

- External BBs are specific to the types of cranks. On Shimano chainsets look for ones that mention Hollowtech II

- Q: i need a new heatsink bracket for my msi k8n neo4 where can i get one that would fit it doesnt have to be the same one. mine broke and it still holds the heatsink somewat butevery now and then the heatsink will come loose and the computer will shut down

- Do okorder

- Q: i had the engine rebuilt and i need help putting back the brackets for power steering and ac unit. i have a 1981 chevy with a 350 engine. if you can i need some kind of drawing to show me where the brackets gothanks alot

- you probably have a friend that has a vehile with the same setup. open the hood and draw a picture, also there were 2 types of powersteering pumps that year be aware you have the same, it is the adjusters that are different

- Q: current rates are (percentages) 10 , 25 , 28 , 33 ,35 - i am trying to find out how many taxpayers fall in each bracket in the united states

- Google tax brackets I apologize. There is virtually no way to get an answer to your question via Googling. I tried for about an hour. I did find that in 2008 there were 98.7 million taxable returns filed. But the table from which the IRS published this statistic did not cluster Adjusted Gross Incomes (AGI) in accordance with the Tax Bracket cutoff values. I took the data from the table and make some very gross determinations of sort-of-useful cut-off values and came up with the following percentage estimates for the fraction of taxpayers in the six brackets: 16.6% , 28.9% , 31.3% , 17.8% , 2.4% , 3.1% You might be able to apply these percentages to the 98.7million figure if you really want to know numbers Bear in mind, though, that at least one study more reliable than my petty-little effort here shows that About 47 percent will pay no federal income taxes at all and The bottom 40 percent, on average, make a profit from the federal income tax, meaning they get more money in tax credits than they would otherwise owe in taxes. For those people, the government sends them a payment. and It is a system in which the top 10 percent of earners -- households making an average of $366,400 in 2006 -- paid about 73 percent of the income taxes collected by the federal government.

- Q: First off, I'm not stupid. English IS my first language and once upon a time I did know this.I read a lot and I see a lot of different ways they're written. I know about clauses and where brackets go but I'm just wondering:-Does the comma go after or before the brackets?-When to use a comma (some brackets in the middle of sentences have commas before them but it's not really necessary?)-If a question or an exclamation is in brackets at the end of a sentence does the full stop still go at the end, like !). ?And about quotation marks:-Same as last question on brackets-Full stop inside or outside the quotation marks? I see bothHow ironic I used brackets asking the questions. anyway.Also after ellipsis do you have to capitalize?

- In America these ( ) are called parentheses, these [ ] are brackets, and the rules for punctuation may be slightly different in other countries. If you have a complete sentence inside parentheses or quotes and it's also the end of the sentence that contains them, you only need one period, question mark or exclamation point.

- Q: for example, if it was 8(5-3x4/6) i have to simplify the number inside the bracket. do i do it from left to right, or do i do the multiplication and division before the subtracting?

- yes order of operations do apply

- Q: I watched a television program a few years back about finances and a young couple who where trying to save money to buy a home. The husband had a full time job and the wife worked part time. The wife's part time income tossed them into a higher tax bracket. As it was calculated out, they would have actually saved money by her not working. I think they might have had some child care expanse as well, but not really sure. Upon hearing this, the young women broke down in tears and said you mean I have been working for nothing? My heart felt for this couple and got me wondering about myself who always quickly volunteers for overtime. Am I doing the same as well?

- Then it was calculated wrong. Addtional income taking you to a higher tax bracket CAN't end up costing more in tax than the additional income. The original income (without the extra, whether it's from a second job, overtime or a spouse's job) would still be taxed the same. The additional income would be taxed at a maximum rate of 35%, and to be that high your total income would have to be over $300K. Add in 7.65% for social security and medicare, state tax that could range from 0 to around 10%, and you'd still be keeping around half of the extra income or more, even if you're making hundreds of thousands per year - for normal people, the tax bite wouldn't be anywhere near half. You need to read up on how tax brackets work. As an example, a married couple filing a joint return in 2006 with $61,300 taxable income is in a 15% bracket. They'd pay 10% on the first $15,100, and 15% on everything over that, for a total of $8440. Earn an extra $10 and they're now in a 25% bracket, but they only pay the 25% on that extra $10, the tax on the first $61,300 would still be the same $8440, plus 25% of the extra $10 which would then total $8442.50. You very casually mention there might have been some child care expense - and that can definitely be a major consideration. If someone is making $8 an hour but paying $6 an hour for child care, then it probably isn't worth working - but that's not anything to do with taxes.

Send your message to us

Brackets Cable bearer (pressed mild teel type) galvanized

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1000 pc

- Supply Capability:

- 100000 pc/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords