Steel Strut Parts for PV Project best choice

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- 5000 pc/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

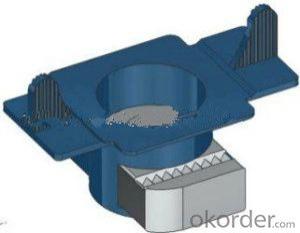

Steel Strut Parts for PV Project

Model no.: C41*41

Thickness: 1.5/2.0/2.5mm

Material: Q235B Q345B

Surface: HD 65-80um

Hole size: 9x30 11x30 13.5x30

Length: Under your request

Model no.: C41*52

Thickness: 2.0/2.5mm

Material: Q235B Q345B

Surface: HD 65-80um

Hole size: 9x30 11x30 13.5x30

Length: Under your request

Payment term:TT / LC/ LC60days.

Deliver time:30days.after received advance payment or correct LC.

Port of loading:Tianjin Xingang,China.

High quality,Best price and Service,Quick Delivery,your Best Choice!

- Q: I got braces about two months ago and I had one bracket fall of while I was just chatting with friends, that got repaired. But last night while I was sleeping I woke up and felt something jolt and I realized a bracket had come lose, and then when I woke in the morning I realized two brackets were lose! I don't understand what it is I'm doing wrong as I eat all the foods I should and avoid the ones that I shouldn't eat. Should I change orthodontist or complain to the one I have now? Can my braces be re-cemented or tightened to fix the problem?Thanks

- When I was a kid and had braces, sometimes the brackets would get loose or even come off. They just re-cemented them back on.

- Q: Im getting my braces off and i wanted to know the process thanks

- first they remove the wire then with the help of special pliers the brackets are take off and the remaining material with which the brackets are attached to tooth is trimmed off and in the last scaling and polising is done and then an impression is made to construst the appliances thats all dont worry no pain occurs during this procedure.

- Q: assuming my total gross income (income + interest + dividends + stock profits - deductibles) falls under 2010 US 15% bracket. i would pay no CG tax right? how do i state that on the tax returns or will the IRS automatically know?

- Step 1. Fill out 1040 schedule D correctly. Step 2. Show income on line 13. Step 3 Show Qualified dividends correctly on line 9b. Don't screw up line 9a. Total is shown in AGI and taxable income. Then when you get to the tax line, you use a worksheet rather than the tax table to calculate the tax. The worksheet splits your income into types. Ordinary (income and interest) and LTCG. After you've figured the tax on ordinary, you'll compare the LTCG with what's left of the 10/15% tax brackets. If any money spills into the the 25% bracket, you'd multiply that chunk of LTCG at 15%. The worksheet is subtle as you never multiply by 0.

- Q: i was eating something hard, and then when i washed my teeth i felt something poking my cheek, when i looked at it, it was a loose bracket.i can probably go to the orthodontist in 3 days, but is it an emergency, can it be dangerous for my teeth in any way? i live in a boarding school so my original orthodontist is far, and i am kind of scared of meeting another one here just please tell me if it is an emergency , and if it could be any danger for the growing of my teeth? Thank you very much in advance :)

- As long as it is not a choking hazard it is not an emergency. It can wait 3 days. I once had one become loose but it was still on my tooth but moved around a little. All they did was glue it back on and it didn't affect my treatment.

- Q: I need a 2007-2008 playoff bracket for the NHL! i can't find one with the semifinals filled in i know that not all of the semifinal match ups have been decided but i would like the current match ups. so please give me a link. thank you very much!

- okorder

- Q: If I sell my rental property this year as opposed to next year will I have to pay capital gains? I am in the 10-15% income tax bracket. Will the capital gains be calculated as income for the year I sell it and possibly send me into the next bracket? Does this have to be a long term sale to qualify?

- From 2008 to 2010 the long term rate is 0% for those in the 10-15% bracket. Remember that any the portion of any gain that would be above the bracket would still be at 15%. I don't know the size of the brackets, of course, but if the taxable income limit for the 15% bracket were $30,000, you had $20,000 regular income and $50,000 LTCG, only $10,000 would get the extra favorable treatment (5% now, 0% later), the other $40,000 would be at the general LTCG rate of 15%. See the link below for one reference.

- Q: I'm getting braces really soon and i have an over bite and my dad said brackets hurt when they brake and is there any other things that i wil need to know for braces.?

- Im not sure what you're dad is saying but thats not true. I had this braces thing called the Herbst appliance and it was bars, screws, caps and brackets all over and one time i broke them eating a fruit roll up (i balled it up and chewed on it and the first chew it broke) and it felt maybe a little pressure but no pain it just popped off. Also for braces once you get them it will hurt for a few days but you can put wax on the brackets to prevent irritation on your lips. Also eat soft foods the first few days so it won't hurt. Also make sure you brush your teeth after every meal! Because with braces your teeth build plaque very quickly and if you don't take care of them you get many cavities, puffy gums, and when your braces come off you have stains from them. Good luck getting your braces!

- Q: I never understood why some sentences have brackets, when you regularly read the sentence as if there is nothing there.For example: Lenny and Carl are very good friends, and [whether they're gay] depends on the show part of the joke is you think they are, and then they talk about their girlfriends.Does that mean someone reworded the sentence from the original source to fit the context more easily or something?

- Brackets are used to fill in information that makes it easier for the reader to understand. Like in interviews, they can't put every single thing in so they use brackets to put in phrases or words so the reader can understand what is bring talked about.

- Q: I have braces and the brackets keep coming offOne of them has come off twice Today one of my front ones came offI've had braces for over 2 yearsAre they coming off because I've had them on for a long time?

- This kinda happened to me also. Are you sure your teeth aren't hitting the other brackets? If so, they can come off eventually from the pressure of other teeth. You can go to your orthodontist and have the brackets re-positioned so the teeth won't hit them. Their not coming off because of having them for this long, it could be the glue, but it's probably not the problem.

- Q: I watched a television program a few years back about finances and a young couple who where trying to save money to buy a home. The husband had a full time job and the wife worked part time. The wife's part time income tossed them into a higher tax bracket. As it was calculated out, they would have actually saved money by her not working. I think they might have had some child care expanse as well, but not really sure. Upon hearing this, the young women broke down in tears and said you mean I have been working for nothing? My heart felt for this couple and got me wondering about myself who always quickly volunteers for overtime. Am I doing the same as well?

- Then it was calculated wrong. Addtional income taking you to a higher tax bracket CAN't end up costing more in tax than the additional income. The original income (without the extra, whether it's from a second job, overtime or a spouse's job) would still be taxed the same. The additional income would be taxed at a maximum rate of 35%, and to be that high your total income would have to be over $300K. Add in 7.65% for social security and medicare, state tax that could range from 0 to around 10%, and you'd still be keeping around half of the extra income or more, even if you're making hundreds of thousands per year - for normal people, the tax bite wouldn't be anywhere near half. You need to read up on how tax brackets work. As an example, a married couple filing a joint return in 2006 with $61,300 taxable income is in a 15% bracket. They'd pay 10% on the first $15,100, and 15% on everything over that, for a total of $8440. Earn an extra $10 and they're now in a 25% bracket, but they only pay the 25% on that extra $10, the tax on the first $61,300 would still be the same $8440, plus 25% of the extra $10 which would then total $8442.50. You very casually mention there might have been some child care expense - and that can definitely be a major consideration. If someone is making $8 an hour but paying $6 an hour for child care, then it probably isn't worth working - but that's not anything to do with taxes.

Send your message to us

Steel Strut Parts for PV Project best choice

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- 5000 pc/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords