Prefab Concrete Floor Panel Molding Machine

- Loading Port:

- Qingdao

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 pc

- Supply Capability:

- 5 pc/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Prefab Concrete Floor Panel Molding Machine

1. Prefab Concrete Floor Panel Molding Machine:

Prefab Concrete Floor Panel Molding Machine works on the long-line table, using the high-strength low-relaxation steel strand as the guide, using the pushing work method to forming the concrete hollow-core slab. The slab have the advantages of smooth surface, high-density structure, capable of making construction slabs of 4.2m to 18m. The GLY series concrete hollow-core slab mainly used on the larger bay workshop, school, hospital, shopping mall, office building, bulk storage plant etc.

2. Main Features of Prefab Concrete Floor Panel Molding Machine:

• One machine can make one slab lower cost, high Wear-resistant, long service life.

• In case of quality problem the company provide free replacement.

• Provide technical support for free.

• Provide consumers with regular visits

• Simple structure, easy operate, less wear parts

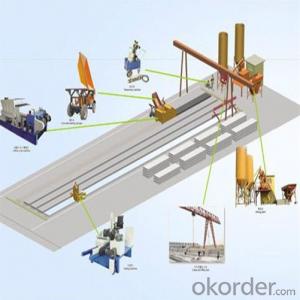

3. Prefab Concrete Floor Panel Molding Machine Images:

4. Prefab Concrete Floor Panel Molding Machine Specification:

Type | Aperture & diameter | Number and diameter of wires | Max span | Total power | Productivity (m/min) | Max. Load (KN/m2) | Overall dimension (mm) | Weight (kg) |

GLY180-1200 | 11/ peach | 12/9.5or12.7 | 9 | 18.5 | 1.1-1.3 | 16.16 | 2900X1500x1200 | 3300 |

GLY200-1200 | 8 /peach | 10/9.5or12.7 | 10 | 22 | 1.1-1.3 | 13.22 | 3700X1550X1550 | 5300 |

GLY250-1200 | 8/ peach | 10/12.7 | 12.6 | 33 | 1.1-1.3 | 11.1 | 3700X1550X1500 | 6200 |

GLY300-1200 | 6 /peach | 8/12.7 | 15 | 40 | 1.1-1.3 | 10.83 | 3700X1550X1500 | 6900 |

GLY380-1200 | 8 /rhomb | 8/12.7 | 18 | 39.2 | 0.8-1.0 | 12.27 | 4600X1850X1600 | 7500 |

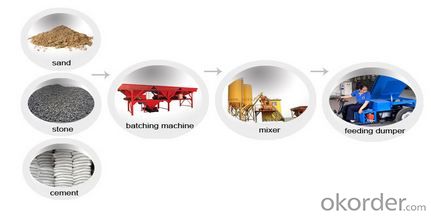

Production Process

Rebar tensioning

Raw materials preparing

Molding

5. Packing & Delivery

• Wire cables are used for fastening the machine on the trailer or inside the container.

• Machine covered with plastic film.

• Machines can be packed in tarpaulin or wooden case according to customer’s needs.

6. FAQ:

We have organized several common questions for our clients, may help you sincerely:

• What information we need to confirm with you before send a formal offer?

What kind of slab you want to make, wall panel, roof panel, lintel or something else?

Do you have exact slab size (slab thickness and width)? If not, please tell us the slab span, we will give you suggestion.

• Have you use this kind of machine before?

Our machine is totally different from European machine. Please don’t follow their instructions.

• How long can we receive the product after purchase?

In the purchase of product, within 20 working days we will arrange the factory delivery as soon as possible. The specific time of receiving is related to the state and position of customers. Commonly 35 working days can be served.

7. Why choose us:

• 30 years manufacturing experience.

• Constitutor of the

• More than 10 patents.

• Passed ISO9001:2000 quality system certificate.

• More than 10 types of machine and over 100 models for choose.

• Supply complete set of technology and equipment solution.

• We can design and manufacture all kinds of concrete forming equipment according to customers' demands. Meanwhile we can even more provide our customers a complete set of technology and solution for all producing flow.

8. Our Service:

• We supply the technical supporting all the time.

• We supply one year warranty for whole machine.

• We supply free quick wear parts.

• We supply low charge continue maintenance when warranty is expired.

• We supply free training to end-users

- Q: Any manufacturers or suppliers give the details of above matter in India

- Here's okorder /

- Q: what is the quality of a central machinery 39743?

- MINI MULTIPURPOSE MACHINE , I'd guess you'll get what you pay for, i.e.. not much. I'd imaging that within it's limited capacity is might be an adequate (depending on ones requirements) lathe, but milling capacity will be quite limited.

- Q: ....i should just glue my mouth shut...

- Nope, ruined your robot

- Q: How to improve the mechanical properties of materials?

- Such as quenching can improve the hardness of the material, quenching and tempering (quenching and high temperature tempering) can improve the stability and toughness of the material to improve the strength of the material processing performance, surface chrome, can improve the surface hardness and wear resistance, corrosion resistance

- Q: Have you ever driven heavy machinery like a fork lift?

- I never have personally, but I work with people who drive them everyday. I work in manufacturing. There's a little tug machine I drive sometimes but its simple and more like driving a car than a forklift.

- Q: Shouldn't insurance companies start considering this when insuring businesses?

- How on earth would an insurance company know someone has an imaginary friend? I would at least hope they drug test them and give them a preliminary psych eval first though.

- Q: plz help! its my homework :P ugh. thanks guys xD

- The Oxford American Writer's Thesaurus does not mention any antonyms. The opposite of a machine might be human labor. Did you mean synonym? (meaning similar) ... If so, apparatus ,hardware, gear, mechanism, gadgetry, tool, engine

- Q: i want to know about machinery manufacturer for essence & perfums making small plant?

- Huh?

- Q: Like what are the major duties for a machinery repairman in the navy? My boyfriend is going to graduate soon from boot camp and is going to be a machinery repairmen. He didn't really get into details. But i just wanna know what do they do? What is their basic day as one? Do they have more sea or shore duty? And would anyone happen to know where he may be stationed?thank you very much!!!Have a good one!!!

- Us Navy Machinery Repairman

- Q: Why won't the machinery implement an optic pie?

- Cherry pie.... is very difficult to find.

Send your message to us

Prefab Concrete Floor Panel Molding Machine

- Loading Port:

- Qingdao

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 pc

- Supply Capability:

- 5 pc/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches