Precast Floor Tile Panels Forming Machine

- Loading Port:

- Qingdao

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 pc

- Supply Capability:

- 5 pc/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Precast Floor Tile Panels Forming Machine

1. Structure of Precast Floor Tile Panels Forming Machine:

Precast Floor Tile Panels Forming Machine works on the long-line table, using the high-strength low-relaxation steel strand as the guide, using the pushing work method to forming the concrete hollow-core slab. The slab have the advantages of smooth surface, high-density structure, capable of making construction slabs of 4.2m to 18m. The GLY series concrete hollow-core slab mainly used on the larger bay workshop, school, hospital, shopping mall, office building, bulk storage plant etc.

2. Main Features of Precast Floor Tile Panels Forming Machine:

• One machine can make one slab lower cost, high Wear-resistant, long service life.

• In case of quality problem the company provide free replacement.

• Provide technical support for free.

• Provide consumers with regular visits

• Simple structure, easy operate, less wear parts

3. Precast Floor Tile Panels Forming Machine Images:

4. Precast Floor Tile Panels Forming Machine Specification:

Type | Aperture & diameter | Number and diameter of wires | Max span | Total power | Productivity (m/min) | Max. Load (KN/m2) | Overall dimension (mm) | Weight (kg) |

GLY180-1200 | 11/ peach | 12/9.5or12.7 | 9 | 18.5 | 1.1-1.3 | 16.16 | 2900X1500x1200 | 3300 |

GLY200-1200 | 8 /peach | 10/9.5or12.7 | 10 | 22 | 1.1-1.3 | 13.22 | 3700X1550X1550 | 5300 |

GLY250-1200 | 8/ peach | 10/12.7 | 12.6 | 33 | 1.1-1.3 | 11.1 | 3700X1550X1500 | 6200 |

GLY300-1200 | 6 /peach | 8/12.7 | 15 | 40 | 1.1-1.3 | 10.83 | 3700X1550X1500 | 6900 |

GLY380-1200 | 8 /rhomb | 8/12.7 | 18 | 39.2 | 0.8-1.0 | 12.27 | 4600X1850X1600 | 7500 |

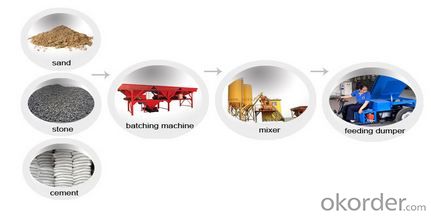

Production Process

Rebar tensioning

Raw materials preparing

Molding

5. Packing & Delivery

• Wire cables are used for fastening the machine on the trailer or inside the container.

• Machine covered with plastic film.

• Machines can be packed in tarpaulin or wooden case according to customer’s needs.

6. FAQ:

We have organized several common questions for our clients, may help you sincerely:

• What information we need to confirm with you before send a formal offer?

What kind of slab you want to make, wall panel, roof panel, lintel or something else?

Do you have exact slab size (slab thickness and width)? If not, please tell us the slab span, we will give you suggestion.

• Have you use this kind of machine before?

Our machine is totally different from European machine. Please don’t follow their instructions.

• How long can we receive the product after purchase?

In the purchase of product, within 20 working days we will arrange the factory delivery as soon as possible. The specific time of receiving is related to the state and position of customers. Commonly 35 working days can be served.

7. Why choose us:

• 30 years manufacturing experience.

• Constitutor of the

• More than 10 patents.

• Passed ISO9001:2000 quality system certificate.

• More than 10 types of machine and over 100 models for choose.

• Supply complete set of technology and equipment solution.

• We can design and manufacture all kinds of concrete forming equipment according to customers' demands. Meanwhile we can even more provide our customers a complete set of technology and solution for all producing flow.

8. Our Service:

• We supply the technical supporting all the time.

• We supply one year warranty for whole machine.

• We supply free quick wear parts.

• We supply low charge continue maintenance when warranty is expired.

• We supply free training to end-users

- Q: Does it have all the details of the threading section? I used Machinery's Handbook for drawings to determine tap sizes, thread dimensions etc for technical drawings. I hate to buy the book again (I lost it in a flood) for the one chapter I really need. Does anyone know if it includes those tables?

- rmatc4 okorder /

- Q: A. physicalB. intangibleC. tangibleD. transient

- i guess c

- Q: ....i should just glue my mouth shut...

- hahahahahahaahhahahahahahhahahhahaah! ROFL! LMAO! LOL! Wait.. Where did you get the robot? o.O

- Q: I'm looking for a machinery for production of mini/small size plastic pots/jars for food (i.e. honey, butter, jam, melt cheese etc). To explain: You can remeber it from Your fligt-all this are provided in small plastic (sometimes glass) pots.

- Theres okorder /

- Q: How to be the agent of zhengzhou Kefid machinery?

- kefid okorder

- Q: Presented here are selected transactions for Snow Company for 2012.Jan. 1Retired a piece of machinery that was purchased on January 1, 2002. The machine cost $66,300 on that date and had a useful life of 10 years with no salvage value.June 30Sold a computer that was purchased on January 1, 2009. The computer cost $31,200 and had a useful life of 5 years with no salvage value. The computer was sold for $12,480.Dec. 31Discarded a delivery truck that was purchased on January 1, 2007. The truck cost $53,000 and was depreciated based on an 8-year useful life with a $6,300 salvage value.Journalize all entries required on the above dates, including entries to update depreciation, where applicable, on assets disposed of. Snow Company uses straight-line depreciation. (Assume depreciation is up to date as of December 31, 2011.)

- Jan. 1 Retired a piece of machinery that was purchased on January 1, 2002. The machine cost $66,300 on that date and had a useful life of 10 years with no salvage value. After 10 years the machinery is fully depreciated. Dr Accumulated Depreciation--Machinery 66,300 Cr Machinery 66,300 June 30 Sold a computer that was purchased on January 1, 2009. The computer cost $31,200 and had a useful life of 5 years with no salvage value. The computer was sold for $12,480. Six months of depreciation has accumulated since the beginning of the year. 31,200 / 5 x 6/12 = $3,120 to update depreciation Dr Depreciation Expense--Computer 3,120 Cr Accumulated Depreciation--Computer 3,120 31,200 / 5 x 3 1/2 = 21,840 total accumulated depreciation at time of sale Dr Cash 12,480 Dr Accumulated Depreciation--Computer 21,840 Cr Computer 31,200 Cr Gain on Sale of Computer 3,120 Dec. 31 Discarded a delivery truck that was purchased on January 1, 2007. The truck cost $53,000 and was depreciated based on an 8-year useful life with a $6,300 salvage value. (53,000 - 6,300) / 8 = $5,837.50 to update depreciation Dr Depreciation Expense--Truck 5,837.50 Cr Accumulated Depreciation--Truck 5,837.50 5,837.50 x 6 = 35,025 total accumulated depreciation at time of sale Dr Accumulated Depreciation--Truck 35,025 Dr Loss on Disposal 17,975 Cr Truck 53,000

- Q: I know the basics - clear cut the trees, put explosives in the mountains, blow the mountain up, separate coal from waste, fill up valleys and then plant some grass. What I want to know if more about the machinery used - some sites talk about a quot;dragline,quot; but don't have any more info than quot;it is used in MTRquot; What kind of explosives are used? How do they gather/separate the coal from the mining waste?

- Draglines okorder /

- Q: why are larger fields needed for machinery such as combine harvesters,tractors and ploughs?

- It's the other way around. Those machines are needed for larger fields. The number of people needed to harvest a corn field that's several thousand acres would be huge and prove to be too costly.

- Q: ok someone help me how much is it for all the machinery to biuld a electric car its for my school project that we have to present to the UofA

- Hobbyists okorder

- Q: why on ship machinery's are installed forward-aft & not port starboard?

- Depends on the designer... Machinery can be placed athwart-ship , fore and aft or a combination of the two if more than two pieces of the same type of equipment are installed. For athwart-ship placement at a given frame location, the numbering starts at the centerline and working outward even numbers go on the port and odd numbers on the starboard. For/Aft placement the numbering increases from bow to stern. Machinery is alway labeled starting at 1 even if it is located on the port side as would be the case of a single unit or the first forward most unit with additional units aft. Some factors that determine how and where machinery is placed include: size, weight, access for operation and repair, how critical the equipment is in relation to safe operation of the ship (number of backups or units to be run in parallel)

Send your message to us

Precast Floor Tile Panels Forming Machine

- Loading Port:

- Qingdao

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 pc

- Supply Capability:

- 5 pc/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches