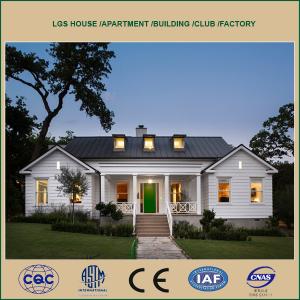

Low cost and good quality steel structure

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Specifications

Steel structure workshop warehouse building

1. ISO9001:2008, SGS and BV Certification

2. Structural safety and reliability

steel structure workshop warehouse building

Characteristics

1. Enviromental friendly

2. Lower cost and maintenance

3. Long using time up to 50 years

4. Stable and earthquake resistance up to 9 grade

5. Fast construction, time saving and labor saving

6. Good appearance

Technical Parameters

Item Name | steel structure workshop warehouse building |

Main Material | Q235/Q345 Welded H Beam and Hot Rolled Section Steel |

Surface | Painted or Hot Dip Galvanized |

Roof & Wall Panel | EPS Sandwich panel /Single Corrugated Steel Sheet/ Colour sheet with Glass-wool, for customers choose |

Window | PVC Steel or Aluminum Alloy |

Door | Sliding Door or Rolling Up Door |

Service | Design, Fabrication and Installation |

We can make quotation according to customer's drawing or requirement | |

(size by length/width/height and wind speed), offering a free design | |

drawing and all detailed drawings for installation. | |

Packing | According to customer's requirement |

Load into 40/20GP,40HQ or 40OT |

- Q: I am still 17 years old, in my senior year of high school. I know you cannot take the liscense exam until you are 18 and must take courses. I am wondering if you can take courses whether that would be online or class courses, while you are 17? (my birthday is in may). I am going to college next year majoring in business with real estate emphasis, and minoring in international business. Any help or suggestions into becoming a sucessful agent and starting young will be great!Thank you

- Follow you dream and study now. Take the test once your 18. While you're going to school, refer deals to another realtor. You won't have time to do it yourself. And clients want to work with full-time Realtors. This way, you can concentrate on school and gain some real estate experience at the same time. Tell your family friends what you're doing. You can't be shy about this. Ask them to keep an eye out for people they know looking to buy or sell. Refer the deals to your full-time Realtor partner. They do the rest of the work, but you still get paid. For licensed real estate sales people or brokers, the usual commission for a referral is 25% of the company's commission. On a $500,000 sale, for example, 25% of 3% is a cool $3750. Do that once once or twice a term - not a bad part-time job that can turn into a career. The real estate market is cyclical. By the time you're done college, we might be experiencing another real estate boom. Good luck!

- Q: I am leaving Los Angeles and moving back to Las Vegas after the first of the year..I cannot handle how much it costs to live here....I want to go to a real estate school in Las Vegas....does anyone have any suggestions?? Thanks!!

- Yea...don't get into real estate. I got my license a two years ago, and finally let it expire. It will cost you at least $1500 to get it. Then you have to pay office fees and a commission split. Everyone knows at least 2 or 3 real estate agents. Factor in a declining, slow housing market, and you will be eating Top Ramon and PB&J. If you coming to Vegas, get on with a big casino, work in one of the many non-casino related industries. Check out craigslist job postings. You don't have to be a dealer, waitress, or real estate agent, there are other good paying jobs here. By all means, if that is what you want, go for it. Just be ready for a rough start. At last count, there were over 19,000 real estate agents in Nevada...do I need to tell you where 75% of them live and work? To comment on the below person's post. Yea, you can take an online course for $350, but you will then have to take your test which is about $100-$120 then you have to pay your dues for MLS, GLVAR, and NAR. I had to write a check out for $1200 once I passed my test.

- Q: I am interviewing and interested in working for Prudential California Real Estate. Can you tell me if this is a good choice? I have been in the auto business for 2 years. Realistically am I going to be able to make some decent money after getting trained and getting my license? Is this the right time?I don't want to get out of the auto business which is decent but exhausting and get into Real Estate and make NO money.Please help.

- Hi there, I just joined prudential Realty in Michigan and your market out there will most definitely be better! The Company itself is just amazing. They offer a great deal of support and training that I have found unparalleled in my search for a broker. To be honest, it is very hard to make money at first. The first six months may go by without a single check. Are you ready for that? However, if you have a big circle of influence and or contacts, it could be much quicker for you. Dues,fees, and the price of marketing is also quite hard at first. Expect to be in the hole at least your first year and then you will be ready to rock and roll!

- Q: I have a few thousand saved up, I am in the military and was wondering if I could do this part time. Whether it be by purchasing a foreclosed home an renting it out, or working for a broker when I end my contract. I have an opportunity to go to college online and I am also wondering what would be a good degree to aid me in the long run in this field. What would you guys recommend? I have no family in the field and do not know anyone who has experience in the field either. Do folks normally have the money required (if they opt on flipping homes) or are loans taken out for the rookie? I live in NC but if I were to get out the military I'd be moving back to New Jersey.... expensive state along with its real estate. If I were to decide in flipping over working for a broker, how much should I have saved up? Thanks in advance.

- Get your real estate broker with 100% commission or one that will send leads to you. After you get a feel for what is a good and bad deal. Then buy

- Q: I have been thinking about getting my real estate license... but I want to know if it's a bad time to get it right now. I live in Dallas. I don't want to spend the money on getting my license and not make any money.

- Chances are very high you could have gotten a license two or three years ago and not made any money. Only 20% of new agents stick with it for a year, and only 10% are still in the business after 18 months. It takes more dedication than most people are willing to extend, and that whole no income for a year or more doesn’t jive with many of them. Now is definitely not the time to try your hand at being an agent. The best many seasoned agents hope for right now is just to make enough money to get by without needing a second job. It’s not that they’re not great agents. It just doesn’t matter how great you are when loans are hard to get so that few people have the power to buy homes.

- Q: i currently enrolled in a real estate class and im not sure if if was worth it i heard that now you might need a two year degree in real estate just to recieve a licence

- Well uh, I don't know that I have heard anything about that. I know that a 2 year degree can be used to obtain the brokers license. Maybe that is what they are changing. I have my license and have yet to hear anything about this. It's really a tough market right now too btw. Lots of work to make some money in this kind of a market and alot of people can't hack it. I would say either way, this was a bad time for you to decide to get your license. I would love to know more about this myself though. Good luck.

- Q: i am considering getting a brokers license in massachusetts, its pretty easy. but since i know nothing about real estate i am wondering how exactly you make money with a brokers license. can someone take me through the process. ex: step 1, pass the test and get ur license....step 10, get paidalso im a student so i cant do anything full time with it.

- one must become a sales person before becoming a broker. And it is anything but easy; 3/4 fail the test the first time. --to help someone sell property, a broker's agent will take a LISTING. to help someone BUY property, an agent will sign a buyer's agency agreement and find what the buyer wants. the seller pays the commission for the seller's agent and the buyer's agent, in most circumstances. the more agents that a broker has, the more likelihood that one or two will CLOSE deals monthly; that commission is split with the broker UNLESS the Agent pays a desk fee. can guide you further if desired; am licensed in a dif state

- Q: I'm interested in pursuing a career in real estate, but I'm worried about the possible lack of opportunities available in this career field during this economic recession.Are my fears justifiable, or do I have nothing to worry about?Also, what other real estate related careers are out there for someone who has a real estate license?

- Being a real estate agent requires constant relationship building and networking and the traditional brokerage format is not for everyone. In any size office, competition is fierce among the agents in the office themselves and from competing firms. You have to have the wherewith all and tuff skin to survive your first couple of years. Besides the cursory training provided you are pretty much left to your own accord. It is the survival of the fittest at the most basic level. Can it be lucrative? Yes it can be but at what cost? Health, family and friends. And the expense! Be prepared to shell out at least a $1000 to $2000 to get started in Realtor fees, MLS fees, lock boxes, business cards, signs, E/O insurance, extra car insurance if you don't have the 100/300/100 limits to name a few. I know I am being discouraging but you have to be prepared for those realities. You have to have some form of additional income before even considering going full time, especially if you plan to work for a traditional brokerage. There are other alternatives like builders and property management firms. Most discourage part timers. If you want to start part time in the business, then email me and I will send you some information on my firm which has a different focus and go beyond the full service brokerage market.

- Q: is it good time to be into real estate? is it bad now and if so when do you guys think it will be come better? i am currently a freshman in junior college and really like real estate. i plan to relocate to los angeles, california. is real estate good there in california?

- I have been a Realtor since April 2006, I have closed over 40 deals since then and made a six figure income from real estate in that year. No that is not typical for the industry, but it is typical for the company I work for. If you get your license look for TRAINING, and I mean real training. Not just watch this agent and you will figure it out. We have classes daily to teach new and experienced agents to take their business to the next level. Now sales is important to real estate but the thing to remember is this: Your most important job as a real estate agent is lead generation, NOT buying and selling houses. You cannot sell houses if you do not have clients. The flexibility in hours is not what you think, I work 9-5 PLUS eveings and weekends. And the only reason I do not work more is I have an assistant who handles a lot of the mundane work for me so I can focus on lead generation and my clients. You can work less but generally speaking, plan on making less... There are agents who work less than than and make more than me, through leverage, that is what I am working towards. There are also those who work more and make less.... They do not focus on lead generation. Health insurance is a biggie to think about, and taxes. As a Realtor, no-one is collecting taxes for you so quarterly payments need to be made to the IRS and state if you have state income tax. It is a very rewarding job, both personally and financially if you work hard and put systems in place to help you succeed. But it is what you put into it, there is no easy $ in real estate.

- Q: I'm very interested in investing in real estate and learning about aquiring new assetsand I'm looking for places to learn about it, are there any videos or books or links or software that you might know of or even a class

- Visit okorder and you can write to forums and also purchase courses. I had a mentoring with Michael Carbonare and I feel mentoring is the way to go. It costs $2500 but he holds your hand for 2 years while you do deals. One on one training is the way to go. Brian...

Send your message to us

Low cost and good quality steel structure

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords