Heavy & Light Steel Structure project

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Light steel structure

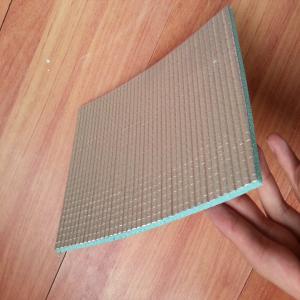

Light steel structure is an environmentally friendly economic plant which is convenient for both assembly and disassembly. Its main load-bearing component is steel, including steel columns, steel beams, steel truss and steel roof. The light steel as the frame and the sandwich board for building materials are installed in standard module series, and components are connected by bolts. light steel structure is suitable for all kinds of modern industrial workshop, logistics warehouse and industrial buildings.

Features:

●Comfortable: Steel structure plant adopts high efficiency energy-saving system with respiratory function, which can adjust indoor air humidity; roof has with ventilation function, which can help form air flow upside the room, therefore satisfying ventilation and cooling demand inside of the roof.

●Time saving: the whole installation belongs to dry construction mainly including connection with bolts, therefore there is no environmental effects of season.

●Environmental protection: 100% of materials can be recycled, which truly realizes pollution-free.

●Energy saving: steel structure of light steel plant uses efficient energy-saving wall, with good thermal insulation, heat insulation and sound insulation, which can save 50% energy.

- Q: Can I buy real estate in Australian while being a Russian Citizen and can I travel back and forth and what Visa do I need?

- Yes they're going to definately upward push exceptionally at auctions in which a further man or woman who has additionally slightly extra financial savings together with the supply can outbid folks who best have the supply. More folks will attend the auctions within the desire of bidding. Also the curb curiosity charges will draw in folks watching for investments -folks who have already got houses and will get larger loans. Any first house purchaser additionally has to comprehend that during a couple of years if and while the curiosity fee rises speedily - are you able to nonetheless preserve your tradition as good as paying plenty additional a week in your loan - simply considering that your curiosity fee is going up doesnt imply that your salary is going up the equal quantity! Dont be cast off purchasing a estate considering that you'll be able to continually promote it if the going received difficult - nonetheless make certain you're no longer purchasing whatever for you to make you a slave to paying it off for the following 25 - 30 years leaving you very little cash to outlive effortlessly. You will continually get your a reimbursement with estate as they're the most secure funding and there may be continually a necessity for houses available on the market - nonetheless, while purchasing a estate make certain you upload into your equation - you'll have to insure the estate, pay charges and taxes each 12 months, fix the estate if wanted, pay emergency levy, water and many others., a few folks purchase whatever that's just a little out in their league financially, with out realising that there can be fees alongside the way in which related to proudly owning a condominium. Do a few study earlier than purchasing - talk to different property owners and make certain you recognize what your funds is and dont accidently get over excited at an public sale within the warmth of the second and buy whatever you particularly can't come up with the money for! Goodluck.

- Q: I was wondering if my d.u.i. conviction could keep me from getting a real estate license in georgia? I have that dui and a minor in possesion of alcohol charge on my record. no felonies or charges having to deal with money or anything.....Thanks

- I don't know, but if you are considering going to Real Estate school, before you spend the money, I would make sure I understood how extremely difficult the market is in our state. My home, my folks' home, my best friend's home have all lost HALF their value. My other friend has 3 houses for sale on her street that are selling for less than 1/3 of what they were selling for 3 years ago. I don't mean to rain on your parade to be cruel, I just want you to know that it hasn't been this hard to make a living in real estate since the late 70's. Georgia is leading the nation in foreclosures, or was recently. Any real estate school can tell you if a DUI prevents you from getting your license and if you don't want to ask, call the Governor's Office of Consumer Affairs, they can steer you to the correct governing agency.

- Q: I am considering a future job in real estate. Im still young and have the opportunity to go to school and this field definetly interests me. The only thing is I dont know is where to start and where I should look into going to school at. Should I go to a company and get my feet wet or should I go to school first. I understand that this is a comm based job but are their other job opportunites that do require pay w/o being a real estate agent first. Just to see if this is right for me it would be great if I could get some info on this matter. Also if anyone can give me some ideas on schools in san diego and even recommend any companies I would greatly appreciate it, thanks!

- I'M A REAL ESTATE AGENT HERE'S SOME HELPFUL INFO. research companies you want to work for before you take your class. find out what companies will sponsor you for your test. For instance Coldwell vs Prudential. They have employees do their training program after you complete licensing and they can tell u upfront about fees they require. If is about a $1500 investment to start your career. Usually 350 for class, 50 for licensing (u need a broker to sponsor you so you can receive your license) You have to pay desk fees, business cards, sometime ur company charges y ou for their training program also joining board of Realtors and state board of Realtors. Joining MLS, multi listing system and having access to those listings. I would recommend that you take your time and realize that this is s business where no one is your friend. They will steal your listings and your client so fast. SO don't think that anyone will be sincere in training you. That is what I have encountered. People are fake in this industry. Realize if it isn't right for you there are other outlets such as working in management offices, mortgages, being a rental agent. There different aspects of this industry that can help get your feet wet. Good luck and dont be afraid to take chance bc u will be surprised in yourself.

- Q: I just finshed my courses for real estate license sales person (CA) and I am worried about the test. Is it difficult or long, multiple choice? I am also interested in getting my apprasial lic. Any one have experince apprasing vs selling? Thanks for any info.

- The RE agent license is a walk in the park, compared to an appraisers license. Appraisers test has a 40% fail rate. Here is what it takes to become a appraiser: Education and experience requirements To be eligible to become a state-certified residential real estate appraiser, you must meet all of the following education and experience requirements. There’s no specific order required to gain this education and experience. After you have completed these requirements, you’re eligible to take the state-certified residential appraiser exam. Experience Before you may take the exam, you must: Find a certified appraiser willing to supervise your work experience as a trainee. Work under the supervisory appraiser to get a minimum of 2 years’ real estate appraiser experience (24 months and 2,500 hours). Hours may be treated as cumulative in order to achieve the necessary hours of appraisal experience. Education To be eligible to take the exam, you must successfully complete: An associate degree or higher in any field or 21 semester hours (at least 3 semester hours each) in all of the following: English composition Principles of economics (micro or macro) Finance Algebra, geometry, or higher mathematics Statistics Introduction to computers: Word processing/spreadsheets Business or real estate law and A total of 200 classroom hours of approved real estate appraisal courses, including all of the following: Subject Hours required Basic appraisal principles 30 hours Basic appraisal procedures 30 hours Uniform Standards of Professional Appraisal Practice (USPAP) 15 hours Residential market analysis and highest and best use 15 hours Residential appraiser site valuation and cost approach 15 hours Residential sales comparison and income approaches 30 hours Residential appraiser report writing and case studies 15 hours Statistics, modeling and finance 15 hours Advanced residential applications and case studies 15 hours Electives 20 hours Good luck.

- Q: i have 2 questions;; 1) Do real Estate agents make a alot of money:&does it have to do with science&technology [it obviously has to do with math; lol]&do people that sell insurance make alot of money?&What about the people; that buy houses then remodel them?

- SOME real estate agents make over $1,000,000 per year. Some make a negative amount for the year. Also, there's very little science or technology involved in normal transactions - and though you must know some math to get your license, almost none is needed to actually do the job. I studied engineering at Purdue for a couple years before getting a degree in Criminal Justice, so I do know math and science. It does surprise me however when I meet loan officers who cannot do math!

- Q: How do I become a real estate agent?What do real estate agencies look for when hiring an agent?What are good real estate agencies in LA or NY?Are there different real estate regulations in LA and NY?

- Well, you don't get 'hired'. You work for yourself with a sponsoring broker. Do a search for real estate schools. Mostbare online and take a month or two to complete. Talk to brokers in your area. Call one to make an appointment and get their advice.

- Q: is the major Business Administration the major for owning and buying real estate?

- A Business major is any student majoring in Accountancy; Finance; Information Systems; Management; Marketing; or Business Administration with an Option in either Business Law, Global Supply Chain Management, Insurance and Financial Services, Real Estate, or Systems and Operations Management. Accountancy, Finance, and Insurance and Financial Services are impacted majors with additional admission requirements. All Business majors share 27 units of common Lower Division core courses and 19 units of common Upper Division core courses. Double Major Requirements Students seeking a double major in the David Nazarian College of Business and Economics must have at least a 3.0 overall GPA and be able to complete both majors within a maximum of 140 units. Transfer Course Requirements Students should be aware that no grade lower than “C” will be accepted on transfer from another institution to satisfy Department or David Nazarian College of Business and Economics requirements. Residency Requirement At least 50 percent of the business and economics course credit units and 50 percent of the specialized major credit units required for the Bachelor of Science degrees in Accountancy, Business Administration, Finance, Information Systems, Management, Marketing and the Bachelor of Arts degree in Economics must be completed in residence at CSUN. Course Requirements Check course descriptions for prerequisite courses. Prerequisites must be completed prior to enrolling in the course.....................Property Manager

- Q: I am thinking of going to real estate school? is the market really bad right now? what other kids of jobs can you work withthe real estate liscense that actually pay decent money? I live in New jersey, incase that makes a difference.

- Real Estate is usually a good career. Hopefully the part of New Jersey you are in, is a mix of urban and suburbs. With sales positions, one needs to advertise, to let the public know that you exist. If you are fresh out of real estate school, volunteer to answer the phone at the front desk as often as you can, people call the office looking for someone to list their homes for them, they don't need to know that you just started. Work with an experienced associate in the office that you get along with and you feel that you can trust, maybe slit the commission with him/her until you can do it on your own. The sky is the limit if you believe in what you are doing and you do it well. Growth will bring financial reward.

- Q: Does anyone know of any schools in Indianapoilis, IN to help you get licensed as a real estate agent?

- Indiana Real Estate Institute in Indianapolis, IN has been offering pre-licensing real estate courses and continuing education since 1992. As Central Indiana’s premier school for real estate instruction, we specialize in brokerage, appraisals, mortgages, property management, construction, investing and consulting. Our professional team will prepare you for Indiana's state exam and your new, exciting career! Dan Miller of Indiana Real Estate Institute has over 30 years of experience with encompassing real estate and brokerage. With over 21 years as an instructor and presenter of Continuing Education topics, Dan Miller has the first hand instruction that will help you become a knowledgeable real estate professional. At Indiana Real Estate Institute, we pride ourselves on providing the best foundation possible for both new students wishing to obtain a real estate license and existing licensees continuing their education. Opening the door to a new career starts here at Indiana Real Estate Institute!......Real Estate Agent Bendigo

- Q: real estate in Mississippi

- Check out this website

Send your message to us

Heavy & Light Steel Structure project

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches