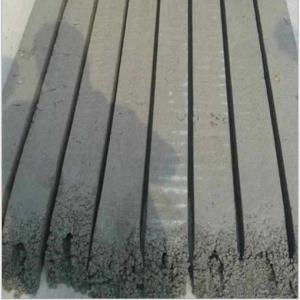

CORRUGATED ROOF ROLL FORMING MACHINE

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- 8 unit/month

OKorder Service Pledge

Quality Product, Order Online Tracking, Timely Delivery

OKorder Financial Service

Credit Rating, Credit Services, Credit Purchasing

You Might Also Like

Main Teachnical Parameters

1.Material thickness: 0.2-1.0mm

2.Feeding width: 900mm

3.Effective width: 760mm

4.Forming speed: 12-16m/min

5.Diameter of the shaft: 70mm

6.Main power: 4KW

7.Forming steps: 16 steps

8.Material of shaft: 45#steel, quenched and tempered

9.Side board thickness: S18mm

10.Material of Rollers: Bearing steel

11.Driven style: by chain

12.Control system: Panasonic PLC

13.Hydraulic cutting part

i.Power: 3 KW

Material of cutter: Cr12, quenched

- Q: I have a go cart with a 6.5 horsepower general machinery small engine. The engine starts right up first pull but as soon as I press the throttle, the engine dies. The only way to use it is if you start the engine with the throttle being pushed, but if you let it idle for about 10 seconds after that it dies. Whats going on here??? Any help would be greatly appreciated.

- clean carb...idles ok but given gas stalls....when u hit throttle u open letting in more air...not enough gas..

- Q: How to be the agent of zhengzhou Kefid machinery?

- kefid okorder

- Q: I know the basics - clear cut the trees, put explosives in the mountains, blow the mountain up, separate coal from waste, fill up valleys and then plant some grass. What I want to know if more about the machinery used - some sites talk about a quot;dragline,quot; but don't have any more info than quot;it is used in MTRquot; What kind of explosives are used? How do they gather/separate the coal from the mining waste?

- Draglines okorder /

- Q: I am going to be an interveiwer interveiwing either a Boatswain Mate or a Machinery Technician. I need links to websites with information about these types of people and their jobs because I need some information. Thank you.

- Boatswain okorder

- Q: In the novel, One Flew Over the Cuckoo's Nest, what does machinery stand for in Bromden's view?

- Machinery represents the accomplishments of man kind and what man kind is capable of doing.

- Q: what is machinery?and its uses.?

- What Is Machinery

- Q: what do companies benefit from when upgrading machinery?

- Depends what you mean by upgrading. A business can upgrade existing machinery to perform faster, better, etc or they can purchase a new machine to replace an older one. With upgrading the business is looking at increasing output, reducing operating costs and improving the efficiency of the machine. A new machine will potentially return less downtime due to breakdowns, but may have teething troubles whilst it settles in. New machinery will have costs involved, not only the purchase cost, but cost of spares, cost of training to operate and maintain, and depreciation. Hope this helps

- Q: technical feasibility study for a theme parkabout machineriesand equipment

- How about what it will take a rollercoster that is fun and safe?

- Q: i like to know what will be the cost of pp woven sack machinery for single unit .it also known as circular loom.

- Check okorder /

- Q: Poll : Can you drive big machinery?

- Does a 155mm self propelled howitzer qualify as big machinery? Drove one while I was in the Marines, it weighed in at 28 tons fully loaded with shells and other stuff. The other piece of big machinery I drove was a M55 5 ton multi-fuel 6x6 truck with a ring mounted M2 .50 machinegun. Driving forklifts, skytraxs and sissorlifts seemed sort of tame after that.

Send your message to us

CORRUGATED ROOF ROLL FORMING MACHINE

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- 8 unit/month

OKorder Service Pledge

Quality Product, Order Online Tracking, Timely Delivery

OKorder Financial Service

Credit Rating, Credit Services, Credit Purchasing

Similar products

Hot products

Hot Searches

Related keywords