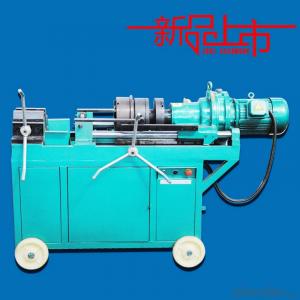

High Quality hydraulic Thread Rolling Machine

- Loading Port:

- Shanghai

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 set

- Supply Capability:

- 100 set/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Quick Details

Condition: New

Model Number: 50

Rated Power: 5.2kW

Dimension(L*W*H): 1700mm x 2000mm x 1400mm

Weight: 850kg

Certification: ISO

Warranty: 0ne years

After-sales Service Provided: Engineers available to service machinery overseas

Machine code: 50

Diameter of spindle: 35mm

Max. hydraulic pressure: 8MPa

Suitable max. steel bar/tube diameter: 50mm

Suitable min. steel bar/tube diameter: 20mm

Suitable steel tube wall thickness: Min. 2mm

Suitable thread pitch: 0.5-4mm

Accuracy of threading: ±0.10mm

Total power: 5.2kW

Weight of machine: 850kg

- Q: Please send me information about some company manufacturing this machinery. I have heard that some overseas companies are there.

- See: okorder

- Q: What is the best way to develop abs quickly without using any machinery?

- lose all your belly fat and then do abs and leg raises

- Q: i've been working out on my arms for 6 months now but can't seem to get any results on the sides of my upper arms.i'm not really skinny,i'm avarage body build but i have skinny arms.i can grow muscle on front and back of my arms,but not on the sides.what are some good exercises,exercise machinery or techniques i can use to target these areas?(and sorry i don't know the technical names for these muscles in the arm)

- mattress of nails by utilising alice cooper sledgehammer by utilising peter gabriel huge undesirable John by utilising jimmy dean, confident, the sausage guy. LOL The God that failed by utilising metallica cock the hammer by utilising cyprus hill

- Q: I forgot :DI think it's some sort of generator - I know there is some piece of equipment or machinery that converts the energy in power plants...Thanks in advance!!

- I don't have health insurance, I'm gonna get fined out the *** for it too. Health insurance doesn't heal anyhow, not a good comparison.

- Q: I want to to start designing and building my own mechanics are there any books or dvds that I can buy or is there any online forums that could give me advice

- www.okorder

- Q: can chimpanzees operate heavy machinery?

- I don't have direct experience but my answer to be definitely yes. Chimps are much stronger than human beings and very close to humans in DNA so they obviously can do some basic 'production line' type operations since they are less 'intelligent' than humans.

- Q: Where do i sell rubber rollers for printing and industrial machineries?

- eBay!

- Q: what is machinery?and its uses.?

- Machinery is a series of components working together to accomplish a particular task. They can be crude, simple machines such as a block and tackle or very complex like a CNC Machine or a monster earth moving crane. Most machinery is used in production or manufacturing.However machinery is als o used to move a ship through the water, dig a tunnel or mine shaft, drill for oil, make a baseball bat, make candy etc. The uses are endless.

- Q: Does anyone know of any cnc machinery apprentice programs in michigan?

- Focus Hope has an awesome program. The first five weeks are free to see if you like it. I know ppl there now. I have passed all the entrance stuff and start in the fall. www.focushope.edu/education/mti.htm

- Q: electric digram for desel generator wih 105 kva

- Call or write to the manufacturer.

Send your message to us

High Quality hydraulic Thread Rolling Machine

- Loading Port:

- Shanghai

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 set

- Supply Capability:

- 100 set/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords