construction hot rolled coiled reinforced bar

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 20 m.t

- Supply Capability:

- 1000000 m.t/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

construction hot rolled coiled reinforced bar

1) Mechanical property:

Steel | Rel/ MPa | Rm/ MPa | A/ % | Agt/ % |

≥ | ||||

HRB500 | 500 | 630 | 15 | 7.5 |

2) Chemical composition :

Steel | C | Si | Mn | P | S | Ceq |

HRB500 | 0.25 | 0.80 | 1.60 | 0.045 | 0.045 | 0.55 |

3)Application :

Construction industry with all types of reinforced concrete structures and so on.

4)Specifications :

Type | Deformed steel bar |

Standard Grade | a. GB1499.2-2007, HRB335, HRB400, etc. |

b. ASTM A615 Gr.40, Gr.60, etc. | |

c. BS4449/1997, etc. | |

Diameter | 6mm-40mm or customer require |

Length | customer inquiry |

Packing | standard export packing, or as per customers' requirement |

Quality | First quality |

Delivery time | 15-35days |

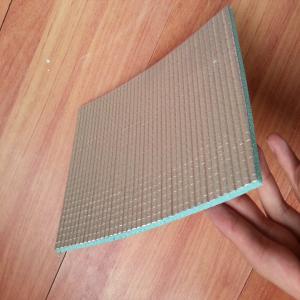

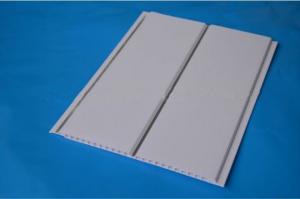

Picture show:

- Q: So....Real estate has suffered majorly during the past year or so. Does anyone know when it is coming back. The obama administrations large scale government spending is going to really weaken the dollar and possibly put the U.S. in hyper inflation by 2010. What are the signs of a recovery in Real Estate? Will this effect Real Estate? Comments? Thanks!

- In uncertain time it's always advisable to buy certain solid assets such as gold, income producing real estate etc. Real estate market of rentals is going to be hot soon, because of the foreclosures, the people who cannot otherwise afford a home had bought homes by cheap money, are now on streets looking for some rental housing. More details click the following links.

- Q: We had an interesting situation happen recently. We are selling our home For Sale By Owner. We had an interested party call us up, talk to us about 10 minutes, and schedule a showing of our hope. They came, looked around and seemed VERY interested. They mentioned they were working with a real-estate agent, and we said we didn't have a problem with that.Anyway, we haven't seen the couple since, two days later the real-estate agent gets a hold of us and tells us he'd like to meet with us tonight to discuss with us the couple and their intentions. I say yeah, he tells me he's going to call us at 6pm that night and come over soon after that.He calls me again 30 minutes later, and says he is about to meet with the prospective buyers. He then starts asking me some very probing questions, specifically trying to find out the exact amount we'd sell the house for. I quickly tell him it's up to the offer price, and who is paying closing costs/ his commission.

- That is why I always recommend not doing business with a friend or relative. What your friend is proposing can get him several years in a federal prison. It is a tough choice for you. Do you just walk away from him and let him commit the fraud with someone else. He is probably aware of the penalties but is willing to take the risk to make big bucks. If you want to stop this crime, call your local FBI office and tell them what you know. They may (or may not) set up a sting or watch his transactions and then pull him in for questioning. By the way, lying to an FBI agent is perjury and can get you serious jail time, Any deliberate misinformation that appears on the closing HUD statement is considered fraud and perjury. A coomon example is: If another agent offers to settle a repair outside of closing by a direct cash payment without notifying the bank, that also is a federal violation. I have been participant to several FBI stings and have given testimony that has resulted in several jail terms, the longest being to a 30 year attorney who committed loan frauds (like your friend proposes) and perjury to the FBI. He is serving 15-20 years now.

- Q: I just finshed my courses for real estate license sales person (CA) and I am worried about the test. Is it difficult or long, multiple choice? I am also interested in getting my apprasial lic. Any one have experince apprasing vs selling? Thanks for any info.

- The RE agent license is a walk in the park, compared to an appraisers license. Appraisers test has a 40% fail rate. Here is what it takes to become a appraiser: Education and experience requirements To be eligible to become a state-certified residential real estate appraiser, you must meet all of the following education and experience requirements. There’s no specific order required to gain this education and experience. After you have completed these requirements, you’re eligible to take the state-certified residential appraiser exam. Experience Before you may take the exam, you must: Find a certified appraiser willing to supervise your work experience as a trainee. Work under the supervisory appraiser to get a minimum of 2 years’ real estate appraiser experience (24 months and 2,500 hours). Hours may be treated as cumulative in order to achieve the necessary hours of appraisal experience. Education To be eligible to take the exam, you must successfully complete: An associate degree or higher in any field or 21 semester hours (at least 3 semester hours each) in all of the following: English composition Principles of economics (micro or macro) Finance Algebra, geometry, or higher mathematics Statistics Introduction to computers: Word processing/spreadsheets Business or real estate law and A total of 200 classroom hours of approved real estate appraisal courses, including all of the following: Subject Hours required Basic appraisal principles 30 hours Basic appraisal procedures 30 hours Uniform Standards of Professional Appraisal Practice (USPAP) 15 hours Residential market analysis and highest and best use 15 hours Residential appraiser site valuation and cost approach 15 hours Residential sales comparison and income approaches 30 hours Residential appraiser report writing and case studies 15 hours Statistics, modeling and finance 15 hours Advanced residential applications and case studies 15 hours Electives 20 hours Good luck.

- Q: I wanted to know the best place for real estate investment in Philippines. Also the tax , and other formalities as well .

- Are YOU a Filipino citizen? Then there are NO best real estate investments as foreigners are forbidden to own land there. It's that simple. Think you can ''get around'' the rules? Think again, many have tried , ALL have failed. You are either a Filipino or a renter. You can own a Condo, but NOT the land it sits on. Ever. Try Thailand or Vietnam.

- Q: I would like to open a real estate company. So I want a best name for my companyWhich name will best for the real estate company?

- Some individuals name their real estate company after themselves. Joe Smooth real estate. They then follow this up with a great catchy slogan. I like foreign names as I think they are exotic. The problem with my selecting foreign names is most Americans are unable to pronounce them.Since this is normally a problem I come up with a catchy slogan. Once I took the first names of my four children and made a name for a mortgage company I formed. Again a catchy logo was used. Whatever name you decide to use, you would have to get it approved by the federal government if you would want to incorporate this company for legal protection. I hope this has been of some benefit to you,good luck. FIGHT ON

- Q: MLM has the following properties1. Multiple levels of experience, expertise, and management, like any business.2. Always promises good pay, even to beginners3. Selling something overpriced4. Commissions are split, and the people on top make more doing less5. Takes time to build your network/customer baseIs that an accurate description of MLM/pyramid scheme, and does real estate differ much from this business model?

- MLM, multi-level marketing, is a business model that requires more and more people to sell in order to make a profit. The riches promised are usually based on the residual income you make from getting people to sell under you. The model is flawed because by the time you and I hear about it every person on the world would have to join in order for us to make anywhere near the profits of the people ahead of us in the pyramid. So, although you point out some similarities, the argument is flawed because of the fundamental difference in the business model.

- Q: like how much does it cost for the exam to be a salesperson in real estate?

- Every state is different. AL is $75

- Q: Hi, I currently live in California and I wanted to know the steps to getting my real estate license. Would it be easier to go to a comminty college or an online class?Thanks for your time!

- The steps involved are listed on the California government website (see below) - a relevant paragraph to your question state: Courses must be three semester-units or four quarter-units at the college level. Courses must be completed at an institution of higher learning accredited by the Western Association of Schools and Colleges or by a comparable regional accrediting agency recognized by the United States Department of Education, or by a private real estate school which has had its courses approved by the California Real Estate Commissioner. Search for approved statutory/pre-license real estate courses. Guessing a real college would be easier, but you might find an accredited online course through their listings (link on their page.)

- Q: What exactly does it mean to trade real estate as long as you're trading up in value ? How does the real estate generate income ? Anything else that you could possibly tell me about real estate would be the best, thanks:)

- When you trade up in real estate, you're not actually trading anything. You're selling a property and using the proceeds of the sale to buy a better, more expensive property. Real estate only truly generates income by being rented or leased out. You buy or own the property, and you charge someone rent to live there. If this income is greater than what it costs to own it (mortgage, taxes, insurance, etc.), this is called a positive cash flow and you're making money. You can kind of consider a property value going up over time as being income generated. But, this income is only on paper, and is not realized until you sell and take your profit.

Send your message to us

construction hot rolled coiled reinforced bar

- Loading Port:

- Tianjin

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 20 m.t

- Supply Capability:

- 1000000 m.t/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches