Pvc Ceilings Kroonstad

Pvc Ceilings Kroonstad Related Searches

Pvc Ceilings Pvc Ceilings Gauteng Pvc Walls and Ceilings Pvc Fencing Pvc Ceiling Philippines Pvc Ceiling Kenya Pvc Down Ceiling pvc ceiling kenya Pvc Ceiling Malaysia Pvc Ceiling Panels India Pvc Crimp Coatedwire Pvc Mat Flooring Pvc T&G Ceiling Upvc Decorative Mouldings Pvc Decorative Wall and Ceiling Panels Nigeria Pvc Ceiling Pvc Tongue And Groove Ceiling Panels pvc tv stand Pvc Bathroom Cladding Panels Pvc Sign Gypsum Ceilling Disadvantages of Pvc Ceiling Concealed Spline Ceiling Disadvantages Of Pvc CeilingPvc Ceilings Kroonstad Supplier & Manufacturer from China

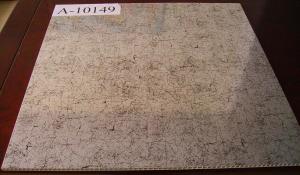

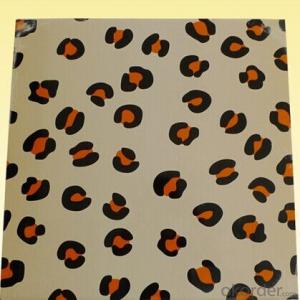

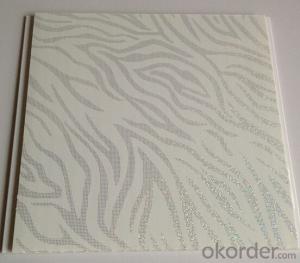

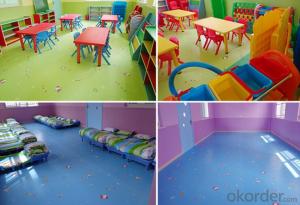

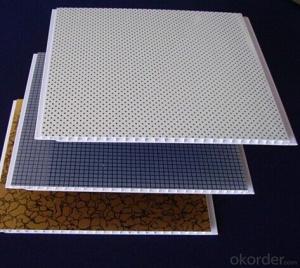

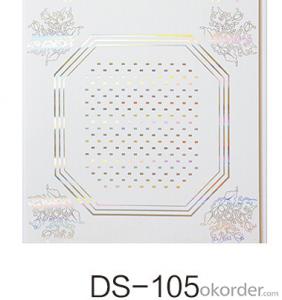

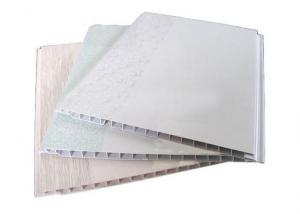

PVC Ceilings Kroonstad is a popular choice for various construction and renovation projects, offering a wide range of products such as suspended ceilings, wall panels, and decorative trims. These products are known for their durability, low maintenance, and aesthetic appeal, making them suitable for both residential and commercial spaces. They are particularly popular in areas prone to moisture, such as bathrooms and kitchens, due to their water-resistant properties.PVC Ceilings Kroonstad are widely used in various settings, including offices, schools, hospitals, and retail spaces, where they provide a clean, modern look while also being easy to install and maintain. They are also commonly used in homes, offering a cost-effective and stylish alternative to traditional ceiling materials. The versatility of PVC ceilings makes them an ideal choice for a variety of applications, from enhancing the appearance of a room to providing a practical solution for moisture-prone areas.

Okorder.com is a leading wholesale supplier of PVC Ceilings Kroonstad, boasting a large inventory that caters to the diverse needs of customers. With a commitment to quality and customer satisfaction, Okorder.com ensures that the PVC Ceilings Kroonstad they provide meet the highest standards of durability and design. This makes them a reliable choice for those looking to source high-quality PVC ceiling products for their projects.

Hot Products