Cement Hollow Core Slab Making Machinery

- Loading Port:

- Qingdao

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 pc

- Supply Capability:

- 5 pc/month

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Cement Hollow Core Slab Making Machinery

1. Structure of Cement Hollow Core Slab Making Machinery:

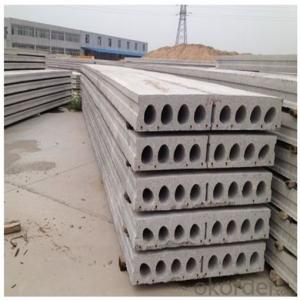

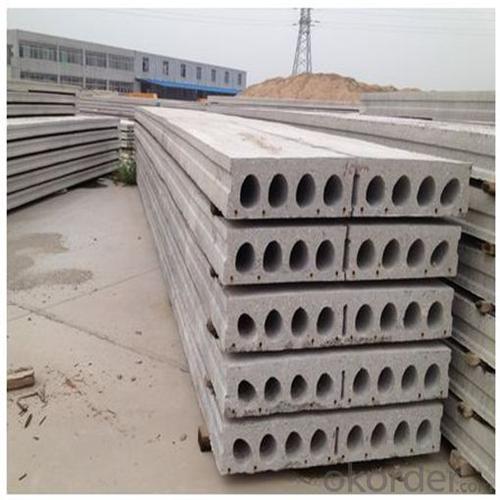

Products of this series (non-circular and circular cored) are the ideal machines for making building materials on constructions of large span and heavy load bearing in factories, schools, hospitals, shopping centers, office building and homes.

Our hollow core slab machines have the advantages of reasonable design, easy operation, convenient maintenance and long working life. Slab length can be achieved to 4.2m to 18m; width of 600mm, 900mm and 1200mm; thickness of 120mm, 150mm, 180mm, 200mm, 250mm, 300mm, 380mm.

The hollow core slab machines are working on the long-line table, tensioning the high-strength and low-relaxation steel strand first, and using the pushing work method to form the concrete hollow core slab. The slabs which being formed have the advantages of smooth surface and high-density structure.

2. Main Features of Cement Hollow Core Slab Making Machinery:

• One machine can make one slab lower cost, high Wear-resistant, long service life.

• In case of quality problem the company provide free replacement.

• Provide technical support for free.

• Provide consumers with regular visits

• Simple structure, easy operate, less wear parts

3. Automatic Cement Hollow Core Slab Making Machinery:

4. Cement Hollow Core Slab Making Machinery Specification:

Type | Aperture & diameter | Number and diameter of wires | Max span | Total power | Productivity (m/min) | Max. Load (KN/m2) | Overall dimension (mm) | Weight (kg) |

GLY180-1200 | 11/ peach | 12/9.5or12.7 | 9 | 18.5 | 1.1-1.3 | 16.16 | 2900X1500x1200 | 3300 |

GLY200-1200 | 8 /peach | 10/9.5or12.7 | 10 | 22 | 1.1-1.3 | 13.22 | 3700X1550X1550 | 5300 |

GLY250-1200 | 8/ peach | 10/12.7 | 12.6 | 33 | 1.1-1.3 | 11.1 | 3700X1550X1500 | 6200 |

GLY300-1200 | 6 /peach | 8/12.7 | 15 | 40 | 1.1-1.3 | 10.83 | 3700X1550X1500 | 6900 |

GLY380-1200 | 8 /rhomb | 8/12.7 | 18 | 39.2 | 0.8-1.0 | 12.27 | 4600X1850X1600 | 7500 |

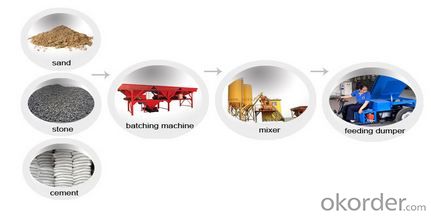

Production Process

Rebar tensioning

Raw materials preparing

Molding

5. Packing & Delivery

• Wire cables are used for fastening the machine on the trailer or inside the container.

• Machine covered with plastic film.

• Machines can be packed in tarpaulin or wooden case according to customer’s needs.

6. FAQ:

We have organized several common questions for our clients, may help you sincerely:

• What information we need to confirm with you before send a formal offer?

What kind of slab you want to make, wall panel, roof panel, lintel or something else?

Do you have exact slab size (slab thickness and width)? If not, please tell us the slab span, we will give you suggestion.

• Have you use this kind of machine before?

Our machine is totally different from European machine. Please don’t follow their instructions.

• How long can we receive the product after purchase?

In the purchase of product, within 20 working days we will arrange the factory delivery as soon as possible. The specific time of receiving is related to the state and position of customers. Commonly 35 working days can be served.

• What kind of machine do you have?

Our main products: large span GLY concrete hollow core slab machine, light - weight wall panel machine, lintel machine, column machine, hollow core slab cutting machine, concrete feeding dumper, high-strength steel wire tensioning machine, which amount to more than the types and more than four hundred standards. We can provide the whole plan and technology supporting for concrete precast component.

7. Why choose us:

• 30 years manufacturing experience.

• Constitutor of the

• More than 10 patents.

• Passed ISO9001:2000 quality system certificate.

• More than 10 types of machine and over 100 models for choose.

• Supply complete set of technology and equipment solution.

• We can design and manufacture all kinds of concrete forming equipment according to customers' demands. Meanwhile we can even more provide our customers a complete set of technology and solution for all producing flow.

8. Our Service:

• We supply the technical supporting all the time.

• We supply one year warranty for whole machine.

• We supply free quick wear parts.

• We supply low charge continue maintenance when warranty is expired.

• We supply free training to end-users

- Q: Jan. 1 Retired a piece of machinery that was purchased on January 1, 2001.The machine cost$62,000 on that date. It had a useful life of 10 years with no salvage value.June 30 Sold a computer that was purchased on January 1, 2008.The computer cost $40,000. Ithad a useful life of 5 years with no salvage value.The computer was sold for $14,000.Dec. 31 Discarded a delivery truck that was purchased on January 1, 2007. The truck cost$39,000. It was depreciated based on a 6-year useful life with a $3,000 salvage value.InstructionsJournalize all entries required on the above dates, including entries to update depreciation,where applicable, on assets disposed of. Ingles Company uses straight-line depreciation. (Assumedepreciation is up to date as of December 31, 2010.)

- You didn't state the year in which these transactions occurred. I'm assuming 2011. Jan. 1, 2011 Retired a piece of machinery that was purchased on January 1, 2001.The machine cost $62,000 on that date. It had a useful life of 10 years with no salvage value. Annual depreciation = $62,000/10 = $$6,200 By December 31, 2010, the machinery would be fully depreciated. Dr Accumulated depreciation $62,000 Cr Machinery $62,000 June 30, 2011 Sold a computer that was purchased on January 1, 2008.The computer cost $40,000. It had a useful life of 5 years with no salvage value.The computer was sold for $14,000. Annual depreciation = $40,000/5 = $8,000 By December 31, 2010, the accumulated depr account would have a balance of $24,000 (3 yrs) You need to depreciate another 6 mths to June 30, 2011 Dr Depreciation expense $4,000 Cr Accumulated depreciation $4,000 after which the accum. depr. would be $28,000, and the carrying amount $12,000. If it was sold for $14,000, there would be a gain of $2,000 Dr Accum depr $28,000 Dr Cash $14,000 Cr Computer $40,000 Cr Gain on disposal of computer $2,000 Dec. 31, 2011 Discarded a delivery truck that was purchased on January 1, 2007. The truck cost $39,000. It was depreciated based on a 6-year useful life with a $3,000 salvage value. Annual depr = ($39,000 - $3,000)/6 = $6,000 By December 31, 2010, the accum. depr. = $24,000 (4 yrs) You need to update depreciation by 1 yr Dr Depreciation $6,000 Cr Accum depr - Truck $6,000 after which the accum depr = $30,000, and the carrying amount = $9,000 Dr Accum depr $30,000 Dr Loss on scrapping of vehicle $9,000 Cr Vehicle $39,000

- Q: What machinery/tools are need to make custom guns?

- A custom gunsmith might be willing to take on the project, but it wouldn't come cheap. If you're talking a gun from scratch it would involve significant machining and metalwork. If your design is based on an existing type of firearm that could be modified to suit you less so, but still talking many hundreds if not thousands of dollars. For a completely new design you'd need a gunsmith with a manufacturing license, not just someone who can fix guns, but one authorized to create a new one, and it would have to have a serial number and paperwork. If you're just talking a different stock design you might want to consider doing the work yourself. A wooden stock is easily shaped with hand tools and can be built up with additional wood and glue to make just about any shape you can imagine.

- Q: Is religion like a horse drawn vehicle, doggedly trudging along, refusing to update its machinery?

- Exactly. Religion is always against social progress and new ideas, always. It is inherently reactionary and prone to decay. One can only reform it so far until the Zeitgeist requires a religion to be discarded due to modernity.

- Q: what rate of depreciation on new machineries purchase?

- The maximum section 179 deduction you can elect for property you placed in service in 2006 is increased to $108,000 for quali?fied section 179 property. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $430,000. Assuming you bought this equipment and it was placed into service in 2006, you dont have to capitalize it and depreciate it. You can elect to expense the equipment up to $108,000. This limitation gets reduced dollar for dollar for the amount of equipment placed into service in 2006 that exceeds $430,000.

- Q: what are the machinery in which threads are used for power transmission?

- Ball screws and ACME screws are often used as the means to provide thrust in a linear actuator. Linear actuators are present in many, many applications.

- Q: Can the shears machine be processed?

- According to the different machine model specifications, to establish the scope of processing materials

- Q: what is the contribution of machinery exports to World business from estonia?

- As a percentage of global exports, Estonia is responsible for 0.078% of the worlds machinery!

- Q: When a virus takes over the machinery of a cell, it forces the cell to manufacture:a. more mitochondria to provide energy for the virus b. more lysosomes for digestion c. more food particles d. more virus particles

- D. Look up the experiment done by Hershey and Chase. In their experiment, they used bacteriophages - viruses that attack bacteria.

- Q: i like to know what will be the cost of pp woven sack machinery for single unit .it also known as circular loom.

- Check okorder /

Send your message to us

Cement Hollow Core Slab Making Machinery

- Loading Port:

- Qingdao

- Payment Terms:

- TT OR LC

- Min Order Qty:

- 1 pc

- Supply Capability:

- 5 pc/month

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords