PIPE AND FITTING

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Made from 100% recyclable materials, CMAX epoxy cast iron pipe systems are not only environmental friendly, but also satisfy many properties necessary to withstand the aggressive conditions both internal and external of the pipes and fittings: these properties include its excellent resistance to abrasion, corrosion, impact and fire. CMAX also has low noise transmission compared to common UPVC drainage pipe systems. CMAX is designed as long lasting building materials.

Standard:

CMAX epoxy cast iron pipe systems with nominal size between 40-300mm comply with BS EN 877.BS EN 877 guarantees the quality of the materials, dimensions and tolerances, mechanical properties(like water pressure, tensile strength and brinell hardness) appearance, and the standard coating for the epoxy cast iron pipes, fittings and couplings.

Strength:

Iron is well known for its strength and abrasion resistance. The shape and impact strength of CMAX products are unchanged under exposure of sunlight and weathering, while UPVC and PVC pipes would soften, deform and become brittle under intense temperature change.

Quiet:

CMAX’s sturdy and dense properties reduce pipe vibration a silent drainage system.Studies had proven iron is the quietest material out of all other common drainage system.

Non-Toxic and Non-Combustile:

No toxic gas will be emitted from CMAX in the event of fire. Iron is also non-combustile,so epoxy cast iron pipes and fittings are recoverable after fire.

Anti-Corrosive:

All CMAX epoxy cast iron pipes and fittings are internally and externally finished with corrosive resistant epoxy coating to prevent fouling and corrosion. The epoxy on CMAX epoxy cast iron pipes and fittings provides an excellent exterior under humid and tropical conditions.

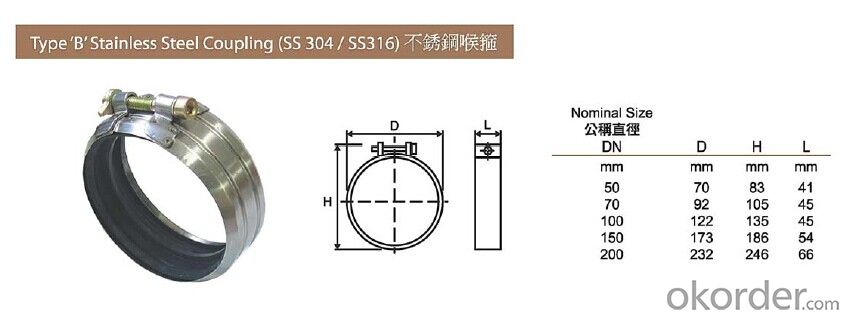

Coupling:

Lightweight couplings are specially engineered to guarantee a strong, quick and easy connection between CMAX pipes and fittings. Made from stainless steel with rubber gaskets, the coupling match pipe and fittings non-corrosive properties.

- Q: I am looking to become a real estate agent through college. How much does it usually cost ( ie. start-up costs, marketing, etc.)? Do the Agencies make the real estate agents pay for office space and is it possible to work from home? How much do the Agencies charge to use their name( ie. like remax, metro, etc.)?Do the Agencies provide any leads for the Agent?Any other advice would be much appreciated,Thank You so much

- While the requirements vary slightly from state to state, but this is the bulk of what you need to do. Graduate High School. You are required to have a diploma or a GED Take a pre-license class from a real estate school accredited by your state. Many brokerages offer the class, and it costs between $200 and $800. The class can usually be completed in two weeks, or spread over a longer period of time. Have a felony free criminal record (though some states real estate commissions will allow you to request a waiver for some acts, such as DUI) Take and pass your state's sales associate test. Good Luck!

- Q: I don't want to be Donald Trump or anything. But I would like to set a goal of owning 100 apartment units. I'm not too sure how to start my endeavor, I'm hoping after I take business I'll have learned all the ins and outs for investing real estate. If anybody could kindly give me some suggestions on how I should start this venture that'd be great

- You start by buying one then use that equity to buy the next. It won't pay enough to compensate you for all your work. Better to invest your money.

- Q: how much would someone need to start investing in homes .and if a operson buys and rents out that house what would be the next step.i really would like to learn about real-estate.

- A good rule of thumb when it comes to investing in real estate is to try and break even. It used to be that if you put 20% down towards the purchase price, you could break even or possibly have a little positive cash flow at the end of the month. If you do buy a place and then rent it out, the next step would be to either borrow some equity against you rental property (if you have any equity that you could borrow and still break even) or you can list the house for sale and invest in a 2-4 unit place. It's good to invest in mid-range areas. Higher end places tend to be more owner occupied, meaning less tenants and the lower end neighborhoods, you may be at risk for housing prices to decline more than they will in the nicer areas. We are in a very interesting real estate market right now, be sure that the Realtor and lender you are working with have your best interests in mind and that they both have good business track records. You can check at the Department of Real Estate to see whether or not they have had any problems in the past. Hope this helps...Oh yeah, don't do any short term-ARM loans, especially the negative-amortization loans.

- Q: Which city, and state, has the best real estate market? I want to be a realtor next year. When I'm 18. But I want to do it right. I'm currently in college for a degree in business. Where is the best place to start at? I'm in Seattle, Washington. Is NY good? Texas? California? Washington DC? Please help. Also, what does it take to be a real estate agent? Can you just hop right into luxury real estate? Thank you.

- Several major cities in Texas have good, stable real estate markets. You'll want to earn a Bachelor's in either Business or Finance to be successful in the real estate business. It's not a pre-requisite to obtain a license however it will be a good foundation. There are fast-track programs where you can earn your license in 3-6 months, or less. Once you have your license and work for a couple of years you are eligible to take the broker's exam, the educational pre-requisite is to hold a Bachelor's degree. As a broker you can hire agents to work under your broker's license and you'll collect a percentage of the commissions. No one hops right into the luxury market until they've closed many high-end property deals in the market area they are working in, and have developed a reputation that earns the respect of the clients they represent (or seek to represent). It's the way it is. Once you have your license, and want to really get your feet wet, borrow some cash and do a flip and list it yourself. Rinse and repeat. Obtain your broker's license and compete for HUD foreclosures to flip and build on your business. When the time is right look into commercial property development. Good luck.

- Q: I am using a non-traditional agent from Help-U-Sell. We have listed our house and after 1 month we have held 3 open houses (1 of which was during a severe rain storm), and had Easter on 1 of the Sundays. We have had a total of 8 people stop by during the open house, none of whom expressed interest in buying the house. Not a single person has scheduled a walk through to date.Help-U-Sell doesnt use the MLS unless I request them to - and I am trying to save on the cost of the commission.What should a good agent be doing to sell my house? Do they do more than just list the house and wait? Need to know if I just need to sit and wait (and hope) or if there are more active ways to assist in the selling of my house.

- The two answers above were excellent. Help U Sell out here does about the same as a regular agent. Seems like you need a new agent or a new company to work with especially if you are opening your own Open Houses. If you feel you are not getting what you need from your current agent than talk to the broker of the company and request to cancel the listing. Find another agent or company that will give you and your house what it needs. That would = closed. HAPPY LIVING!

- Q: I don't know a lot about it , but i loveee houses. I think it would be such a cool job, and i hear you can become quite wealthy from it too. Ive heard there has been deflation on houses, so does that affect the want for more real estate agents? what is average salary? are there any colleges known for giving a good education on real estate? thanks------- marshall

- NO salary for agents; salary for staff; office managers, designers, architects, etc. colleges, no [yes, colleges offer the same thing but it takes WAY longer] lots of RE schools-for speed and good, fast answers. what do you LOVE about houses? Can guide you.

- Q: Who handles his real estate transactions and contracts?

- Wouldn’t you expect Trump to use many different real estate law firms? I mean if he had just one, wouldn’t everyone know that THE DONALD would likely be sitting across the table in any transaction that singular firm handles. It would make it very difficult for Trump to negotiate, if every buyer/seller knew they were dealing with a rich guy. I heard that 60 Minutes tried to just estimate Trump’s worth. Apparently they got vastly different numbers from different investigators. I think that this is because Trump has so many different corporations and legal structures that is difficult for an outsider to know about them all. If he goes to this much trouble to hide his identify through asset protection, it is probably a safe bet that he does not use a single real estate law firm, or broker

- Q: I would like to go to real estate school and get my license but I'm strapped on funds. Any suggestions?

- Check with your local brokers. Some may offer signing bonuses or tuition payment for new realtors.

- Q: My father's interested in buying a house and have it rented out. He's saying it's a really good investment and we can really get a good sum of money from it. Could you give me any websites that talks about all the things related to investing in real estate? I'm curious at all these especially during these hard economic times and money is hard to come by.

- it is better to invest on real estate

- Q: I'm trying to determine whether or not I should go to school to become a real estate agent. I'm a stay at home mom, my husband is a contractor and we currently dabble in real estate investment. We only own one property right now which we bought when prices were down, brought up to code/remodelled and will hopefully be selling soon now that the prices in the area have risen substantially. And if it goes well, we might do it again in the future.What I'm really worried about is... can one be a realtor and a real estate investor at the same time? Is it ethical for the same person to be buying, fixing up and selling the house?I'm not just doing this to save a few bucks on realtors fees... I'm generally interested in the real estate industry, revitalizing the neighborhood we live in and helping people find or sell their homes. I just want to make sure there isn't any legal or ethical issues at hand before I enroll in realtor classes or buy any other properties.Thanks in advance.

- ok i'll have a shot at this. I'm a relator and will try to walk you through it and hopefully you can come to a good decision. First off yes you can be a real estate investor and agent at the same time, only you must disclose the fact to the Seller and their agent in WRITING before you buy . Secondly you said you wanted to be an agent to save on fees, well this won't be the case to be an agent you have to be assosciated with a broker, the broker owns the listing not you. Sometimes after you have sold a few properties you can sell one of your own without owing the broker a commision, but you'd have to working full time. To retain your licence you must work at least 235 hours per week, 40 weeks out of the yesr. Only way to avoid paying broker a fee is to become a broker to do this you need to have a college degree and 2 year real estate experience, plus proof of financial stability. Also make sure the school you intend to go to is approved by the real estate division in your state, and make sure you know where the testing centre is. Basic start up fees vary depending on the brokerage you decide to work for, varying from a couple hundred buck yo a couple of thousand, then you have relator membership fees, plus business licences and other levies placed by you state, city and muncipility, however if all this doesn't put you off it can be a very rewarding career. Be sure to check out your states education requirements and state specific laws as these vary from state to state by googling the real estate division and your state. I wish you the best of luck

Send your message to us

PIPE AND FITTING

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords