FITTINGS AND PIPE CAST IRON DRAINAGE

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

Made from 100% recyclable materials, CMAX epoxy cast iron pipe systems are not only environmental friendly, but also satisfy many properties necessary to withstand the aggressive conditions both internal and external of the pipes and fittings: these properties include its excellent resistance to abrasion, corrosion, impact and fire. CMAX also has low noise transmission compared to common UPVC drainage pipe systems. CMAX is designed as long lasting building materials.

Standard:

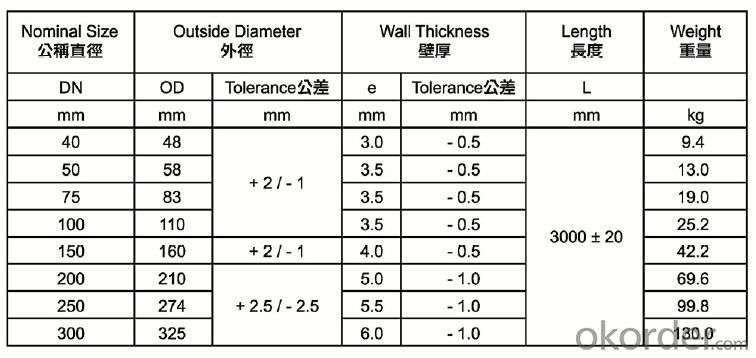

CMAX epoxy cast iron pipe systems with nominal size between 40-300mm comply with BS EN 877.BS EN 877 guarantees the quality of the materials, dimensions and tolerances, mechanical properties(like water pressure, tensile strength and brinell hardness) appearance, and the standard coating for the epoxy cast iron pipes, fittings and couplings.

Strength:

Iron is well known for its strength and abrasion resistance. The shape and impact strength of CMAX products are unchanged under exposure of sunlight and weathering, while UPVC and PVC pipes would soften, deform and become brittle under intense temperature change.

Quiet:

CMAX’s sturdy and dense properties reduce pipe vibration a silent drainage system.Studies had proven iron is the quietest material out of all other common drainage system.

Non-Toxic and Non-Combustile:

No toxic gas will be emitted from CMAX in the event of fire. Iron is also non-combustile,so epoxy cast iron pipes and fittings are recoverable after fire.

Anti-Corrosive:

All CMAX epoxy cast iron pipes and fittings are internally and externally finished with corrosive resistant epoxy coating to prevent fouling and corrosion. The epoxy on CMAX epoxy cast iron pipes and fittings provides an excellent exterior under humid and tropical conditions.

Coupling:

Lightweight couplings are specially engineered to guarantee a strong, quick and easy connection between CMAX pipes and fittings. Made from stainless steel with rubber gaskets, the coupling match pipe and fittings non-corrosive properties.

- Q: I'm a senior studying sociology and I will take a year off to apply for law school. Job descriptions always require at least 3-5 years experience in real estate transaction. How where should I start to fulfil the requirement of Real Estate Lawyer job description?

- Do you desire to grow to be an somewhat property legal professional or an somewhat property broking? whether it particularly is a legal professional you desire to grow to be, then any 4 3 hundred and sixty 5 days instructions degree, plus regulation college, then prepare for the bar examination (observe: there is not any unique examination for relatively property regulation, in user-friendly terms a time-honored examination), then prepare to regulation businesses specializing in relatively property transactions, or % out coverage businesses, or doubtlessly banks that have a sturdy relatively property lending branch.

- Q: im a 20 year old male that wants to invest in real estate and stocks. i kno more about real estate than stock which i kno absoultely nothing about. i need a book that gets right to the point i dont have time to waste i need one solid book for real estate and one solid book for stocks.. answers are needed thanks

- I am a real estate developer and your question is one that a lot of people ask, but the thing is, there is no single book that can teach you this stuff. A lot of it comes from experience, and despite what you hear or see on TV, it's not a quick and easy thing, especially right now given the credit crunch brought on by the housing market. If you truly want to get into real estate, i would recommend you signing up for real estate classes and getting your license. After that, go get a job with a commercial brokerage firm or property management company somewhere and learn what it takes to buy, manage and sell property. After you have a couple years under your belt doing that, you might consider doing it on your own, but in all honesty i wouldnt recommend doing it any way other than that. You need time to truly feel out your market and the type of property you would want to invest in so that you dont get hung out to dry like a lot of people who rush in thinking they are going to make millions and instead lose everything. Real estate is a lot of fun, but it isnt a get-rich-quick industry as a lot of people would have you believe. It's a relationship business! Good luck!!!

- Q: First off i love going house shopping and just going to look at houses, i love houses. What i want to do after i graduate is to own trailer parks and suburb homes and rent them out, if i start with 500k lets say and i buy a trailer park for 500k straight up, no loans or anything and i get the rent from that park and save up and save up and then just keep buying houses and trailer parks slowly will i be successful? And how and can you be successful investing in real estate in the stock market?Anything will help,Thanks

- yeah but you have to know your stuff and be able to talk things up!

- Q: I saw a two bedroom condo in my complex for sale for $65,000.00 online. I pay $600.00 a month for my 1 bedroom apartment. Say I borrowed the $65,000 from a bank to buy the condo. I pay 5% annual interest on a 30 year fixed at $300.00 a month.I can rent out the property for at least $600.00 a month. I'm not sure of my math here but I think I would clear at least $200.00 a month. With owning that property I can borrow against it to buy another property and so on. I guess this is why people get rich in real estate. I see my path but am nervous. What should I do?

- Income property is one of the best investments that not only protects against inflation, it can also provide many tax benefits. However here are some factors you need to also consider: 1. Don't assume you will have the place rented quickly or for the full year. For the months when the place is not rented, you still have to pay the mortgage. 2. Screening and choosing a tenant is a highly risky exercise. Everyone who owns income property has been stiffed by a deadbeat who wouldn't pay costing you months of lost rent and the costs to evict them. 3. Unexpected repairs will occur, especially since renters generally don't treat the property as you would. So, make sure you have a cash reserve to cover at least 6 months of mortgage payments plus property taxes and insurance. To minimize the risk on no. 2 - hire a realtor to list and screen tenants for you. The expense is well worth paying since you can write it off as professional fees and commissions. Good luck!

- Q: I have an A.S in Real Estate, Bachelors in Architecture, and plan on getting my masters in real estate development. Will being an architect, a real estate broker, and a building contractor at the same time give me an advantage to be a successful real estate developer??? What do you think?

- Beyond all the data knowledge that you need to be a real estate developer- is money. You need to be very good at raising money- and planning how to work around issues that come up. For instance the time from the very start of a project (planning it and finding the property) to the end (selling the buildings) can zoom from 5 to 10 years very easily. We don't know what the economy will be like in one year- much less ten years. We also don't know much about the building and zoning requirements will be in the future years. You will need to be constantly going back to your investors and telling them why you need more money- and why it will be a while before you can return anything to them. The Excavation of the site for the Empire State Building began on January 22, 1930 (I don't know when they got the permits or started raising money). They had no idea how long the great depression would last. It is said that it did not make a profit for the investors until 1950. So how good are you at talking people into investing huge sums of money?

- Q: i am considering getting a brokers license in massachusetts, its pretty easy. but since i know nothing about real estate i am wondering how exactly you make money with a brokers license. can someone take me through the process. ex: step 1, pass the test and get ur license....step 10, get paidalso im a student so i cant do anything full time with it.

- one must become a sales person before becoming a broker. And it is anything but easy; 3/4 fail the test the first time. --to help someone sell property, a broker's agent will take a LISTING. to help someone BUY property, an agent will sign a buyer's agency agreement and find what the buyer wants. the seller pays the commission for the seller's agent and the buyer's agent, in most circumstances. the more agents that a broker has, the more likelihood that one or two will CLOSE deals monthly; that commission is split with the broker UNLESS the Agent pays a desk fee. can guide you further if desired; am licensed in a dif state

- Q: I signed the offer to purchase real estate on this past Saturday with the listing broker and my broker [represents me], but the seller did not sign it that day i.e., Saturday. On Sunday I had second thoughts so I told my broker don't want the house at 2 PM and she immediately told the listing broker the deal is off. The catch is on Sunday [time is unknown because no time stamp on fax] the seller signed the offer to purchase real estate. Is the offer to purchase real estate still valid and enforcable?The problem is the listing broker refuses to give me back the check, she deposited on this past Monday. I had my broker contact the listing broker, but that got no where. The listing broker supposely has hired a lawyer for consule. I don't want to go through an inspection to get out of it because it will cost a couple hundred dollars and would be a real hassle to face the listing broker not to mentioned the expiration date to do the inspection would be tomorrow i.e., 3/9.

- you're actually not using the superb suited terminology. an grant to purchase isn't a settlement. that is in user-friendly terms what it says - an grant to purchase. It will become a settlement while the seller accepts it because it particularly is written. till your grant particularly knocks the sellers' socks off, they're going to often provide you a counter grant, or they're going to grant to settle on your grant with specific differences or contingencies. It genuinely will become a settlement in user-friendly terms in spite of everything words have been agreed on and signed by technique of all events worried. in case you're a amateur, and judging by technique of your question, i might guess which you're, you particularly could get carry of professional suggestion formerly writing an grant. in the experience that your phrasing isn't superb suited, you may get yourslef into deeper water than you opt to be in. I advise that if y ou don't have a real property agent representing you, you particularly want an ttorney to write down the grant for you and to lead you in the direction of the entire transaction. confirm to get an legal professional who makes a speciality of genuine property regulation. as a great way because of the fact the type itself in worried, you may get carry of one from any workplace table certain grant shop. you do no longer possibly want a particular sort nevertheless. you are able to write or form an grant on a undeniable sheet of paper, yet considering the fact which you're a amateur, i do no longer advise this for you. Please get carry of the centers of the two a Realtor or an legal professional on your secure practices. do no longer attempt to do this on your guy or woman. There are too many opportunities which you would be able to make a severe mistake.

- Q: I am looking for a part-time (in or near Pasadena, CA) or online real estate MBA program. Any ideas?

- While most MBA programs do offer part-time programs, there are few that are focused on only real estate. Many don't even offer real estate coursework as part of the program. Your best bet will be with a large campus that has a variety of course offerings, but I doubt if you'll find one that is focused entirely on real estate.

- Q: Equinaire is a California company that teaches you how to buy real estate using the equity in your home.

- No. But anyone who tells you at your level of experience and knowledge to go in debt to invest and buy real estate by using your home as security is doing you a disservice, especially as roller coaster natured as California real estate is. There will even be someone who will counter my comments herein to say how wrong I am and tout their success. I recall the Bible verse that says Many are called but few are choosen. So as you are filing the bankruptcy forms it is too late, and you'll remember to not do it again. I have helped people like you write the letters of explaination for their financial failures enough to know that for the average person it is not a wise decision to gamble with the family home and its security. You need to save some funds, for in the next yr or so there will be forclosures in CA that you will be able to get favorable bank financing on at good prices. I'd suggest that a better investment is a commercial income producing property that has long term leases and low turnover with credit tenants if possible. A lot of these guru people that tell you to go in debt also have disclaimers in small fonts that also say ...these results are not typical. There will be a few that do succeed and those few will be the featured guests- who are also compensated for their endorsement. Several of those same guru pitching their material have also been bankrupt but they do not tell you that, because you would then not buy their program because it did not work for them not does not work for most people. That is why they now tell you how to get rich, as they get paid- by you up front for their knowledge or technique. Many simply tell you what you want to hear, an easy way to get wealthy when in fact there is no such way or everybody would be doing it. True, real estate is a good means to grow wealth but there are better ways to invest in real estate with less risk than leveraging your home thereby putting it, possibly your marriage and family at risk.

- Q: I am thinking about getting into real estate...I know there's more money in commercial but its harder to break into....any tips/ideas/suggestions?

- There is one rule to remember in commercial real estate whether you are a buyer and holder, or someone who makes money on the management side: financial value is judged on what can be made going forward, not what it was in the past. The trick is to identify this potential and what can be done to build value going forward. The following drivers are important to consider when examining potential value in commercial real estate: 1. Location. Location. Location. Potential value will come from a high-traffic area with strong demographics, an area where new condos or subway line expansion are great examples. Being closer to transit or places easily accessed by walking is also attractive. 2. Revenue, cost and capitalization rate People sometimes forget the cost of upcoming vacancies. Is there a major tenant about to leave? Any zoning and developing issues/trends? What else is coming up in the area? All this impacts capitalization rates, an important measurement of risk, so avoid thinking of a property in isolation. For more tips visit: richardcrenian.ca/spotting-value-in-commercial-real-estate/ Richard Crenian

Send your message to us

FITTINGS AND PIPE CAST IRON DRAINAGE

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

Similar products

Hot products

Hot Searches

Related keywords