ceramic proppants HD 16/20

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

You Might Also Like

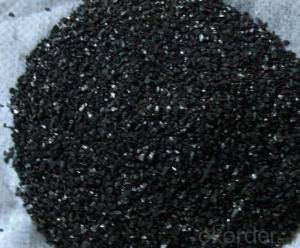

We are one of China's leading manufacturers who has owned patent technology in producing and exporting ceramic proppants used in the hydraulic fracturing process to increase the productivity of oil and gas wells. We can also produce ceramic proppants with different specifications according to clients' particular requirements.

The raw material is proportioned by the computer after being carried into storage bins, crushed into powder by the cylinder ball mill, blew into storage bin through pipes in which the materials are fully mingled, then carried to the pelletizing shop.

After spraying-pelletized by rotary granulators with 2m and 4m diameters, drying and dedusting, sieved by the multi-functional screen, the semi-finished product is sent to the storage bin and sintered by the rotary kiln, and eventually cooling, crushing, dedusting, rescreening, then packed and stored in the warehouse.

We constitutes a sound quality assurance system according to ISO9001-2008. The products have successively passed tests of the authentication of Reservoir Stimulation Laboratory of RIPED-Langfang Petro China, Stim-Lab and Frac-Tech Lab. Being certified as one of the top network suppliers of CNPC and SINOPEC. The excellent performance wins us customers from major oilfields and oilfield-services firms home and abroad, such as CNPC, SINOPEC, etc

- Q:API crude oil inventory data

- When crude oil inventories increased, indicating that excess supply of crude oil on the market, resulting in lower oil prices, the dollar rose.When crude oil inventories decreased, indicating strong demand for crude oil on the market, leading to rising oil prices, the dollar fell.U.S. crude oil inventories official data for EIA data, the latest EIA data please attention: crude oil inventory data

- Q:What is the correlation between crude oil prices

- In the long run, when the dollar depreciates, crude oil prices rise; and when the dollar is strong, crude oil prices are down. Despite the recent economic downturn in the United States a few years ago, but the double deficit is still very serious, the dollar rebounded limited. If this situation continues for a long time, it is easy to shake the confidence of the world's confidence in the dollar, so the United States with another hard currency, crude oil to support the weak dollar, in order to ensure the sustainable development of the U.S. economy. In general, the dollar and crude oil prices are different from the change of the relationship, that is, the depreciation of the dollar will lead to rising oil prices, the appreciation of the dollar caused by falling oil prices.

- Q:What about the impact of the US dollar rate hike on crude oil?

- The impact of the dollar's decline on oil producing countries is to reduce the purchasing power of these countries and push up domestic inflation, relative to the dollar appreciation of the country's demand for crude oil will rise. Another micro observation is that the depreciation of the dollar will greatly increase the demand for gasoline in the United States, because many people who plan to travel to Europe will choose to stay at home. As European countries heavy crude oil tax rate, roughly from European countries cannot benefit much decline in crude oil prices

- Q:What does it mean to buy and sell crude oil

- Spot crude oil to do more short explanation is as follows: do more to buy a piece, that is to buy shortThe spot is not the meaning of crude oil empty single positions, but short, popular is simply to buy down the list. Short of crude oil in the process of trading power to promote Huo Jia Ju Huang Wei Dan save one mode of operation of the means, when prices are expected to fall in future, according to the current price of crude oil will be in the hands of sell, so prices fell after the buy, access to post profits.

- Q:What is the relationship between crude oil and gold and silver?

- Gold prices are positively correlated with crude oil prices. Gold and crude oil are mainly denominated in dollars. Gold is a hedge against inflation, and rising oil prices mean inflation will follow, and the uncertainty of economic growth will increase.

- Q:Theoretical basis of technical analysis of spot crude oil?

- Hypothesis two: prices evolve in a trendThe concept of "trend" is the core of technical analysis. The significance of the study of the crude oil investment platform chart is to reveal it in a timely and accurate manner in the early development of a trend, so as to achieve the purpose of trading along the trend. As a matter of fact, technical analysis is to conform to the trend, that is, to judge and follow the trend of the future.From the "price to the trend of the evolution of the way," it can be inferred that, for an existing trend, the next step is often in the direction of the existing trend continues to evolve, and the possibility of turning back is much smaller. This, of course, is the application of Newton's law of inertia. It can also be said that the current trend will continue until the reverse. Although this sentence is almost the same language repeatedly, but here to emphasize is: unswervingly adhere to a trend, until there is a sign of reverse.

- Q:What is the meaning of spot crude lock?

- For example, there are more than a single, prices fell even too many losses, would be a single and same number of hands empty at the right price, there are more than a single same and empty single account so that the loss of control in a certain range. Hope to help you.

- Q:EIA crude oil inventory increase or decrease will have any impact on the dollar exchange rate?

- When crude oil inventories increased, indicating that excess supply of crude oil on the market, resulting in oil prices fell, the dollar rose, gold fell.When crude oil inventories decreased, indicating strong demand for crude oil on the market, leading to rising oil prices, the dollar fell, gold rose.

- Q:Spot crude oil several opening

- Every morning from 6 to second days in the morning at 4 am is a complete spot trading hours of crude oil for 22 hours. The time limit for the trading day of the trading day at 4:00--6:00 am.

- Q:What does it mean for spot crude oil?

- Here must first talk about the concept of leverage. All transactions are executed with borrowed funds. This allows you to leverage leverage. 10:1 leverage allows you to deposit 100 yuan as a deposit can be traded in the market for RMB 1000. This means that you can immediately search for more money in the market than your account in order to take advantage of the smallest currency changes. On the other hand, leverage can significantly increase your loss. The use of any level of leverage for foreign exchange transactions may not be suitable for all investors. Of course, the amount of money required to hold a position is called the margin requirement. The actual deposit deposit can be regarded as necessary to maintain open positions. This is not a fee or transaction cost, but only a portion of the net value of your account will be allocated as a margin deposit.The problem can contact me.

1. Manufacturer Overview |

|

|---|---|

| Location | |

| Year Established | |

| Annual Output Value | |

| Main Markets | |

| Company Certifications | |

2. Manufacturer Certificates |

|

|---|---|

| a) Certification Name | |

| Range | |

| Reference | |

| Validity Period | |

3. Manufacturer Capability |

|

|---|---|

| a)Trade Capacity | |

| Nearest Port | |

| Export Percentage | |

| No.of Employees in Trade Department | |

| Language Spoken: | |

| b)Factory Information | |

| Factory Size: | |

| No. of Production Lines | |

| Contract Manufacturing | |

| Product Price Range | |

Send your message to us

ceramic proppants HD 16/20

- Loading Port:

- China Main Port

- Payment Terms:

- TT OR LC

- Min Order Qty:

- -

- Supply Capability:

- -

OKorder Service Pledge

OKorder Financial Service

Similar products

New products

Hot products

Hot Searches

Related keywords